Summary:

· dYdX has built a decentralized exchange (DEX) for perpetual futures on layer 2 of Ethereum using zero-knowledge rollup technology. The DEX is built on a central limit order book (CLOB) model with market makers providing liquidity to the exchange. dYdX functions in a decentralized manner but the order book runs on centralized servers. The team is working towards full decentralization.

· The DYDX token was introduced in early September 2021. DYDX is a governance token that grants voting power over the layer 2 protocol. Due to regulatory concerns, the token does not have any right to dYdX trading fees or a token burn.

· dYdX is incentivizing trading on the layer 2 protocol by rewarding traders with ~3.8m DYDX tokens per epoch (28 days). These rewards are paid based off fees paid and average open interest during each epoch. This incentivization mechanism has proved very effective. dYdX is the leading DEX for perpetual futures based on volume.

· The perpetual futures market has exploded in growth in 2021. In Q3 2021 perpetual futures volume was +418% YoY to $13.4 trillion in volume. In October dYdX did almost $100.0 billion in trading volume up from under $1.0 billion in July. The recent retreat of CEXes from China and regulation in the United States continues to act as tailwinds for DEXes.

· dYdX is the leading perpetual futures DEX but competition is ramping up. Perpetual Protocol will soon launch v2 of their protocol. MCDEX has a trading incentives program for Binance Smart Chain and Arbitrum. Mango Markets, Drift Protocol, and others are building on Solana.

· In comparison to competitors dYdX is trading at a relative discount to total value locked (TVL) and average daily volume. This could be due to the lack of cash flow/fee burn rights for the DYDX token, focus on fully diluted value (FDV) compared to market capitalization, and the short interests on perpetual contracts for the DYDX token itself.

· The DYDX token underperformed competitors and the market during October. There is an important upcoming catalyst with the passing of DIP 3. The safety staking contract had issues at launch but will be reinstated for use on November 19. This will allow DYDX token holders to stake their funds for rewards each epoch.

Introduction:

dYdX is a decentralized exchange (DEX) that supports spot trading, margin trading and perpetuals trading on the Ethereum blockchain. In addition, dYdX also offers borrowing and lending. dYdX was founded in August 2017 and initially raised a Series Seed funding round in December 2017; the exchange has been a work in progress since. The core product is the perpetuals trading platform running on a layer 2 scaling solution on the Ethereum blockchain.

Early in 2021 dYdX launched perpetual futures trading on a zero-knowledge rollup layer 2 solution. The perpetual futures trading on this layer 2 protocol represents the lion’s share of trading volume for dYdX and will be the focus of this report.

While the layer 2 perpetual futures protocol is decentralized in nature, there are centralized components that dYdX plans to decentralize over time. Thus, in its current iteration, the dYdX layer 2 protocol is technically a hybrid between a decentralized and centralized exchange.

Decentralized exchange: a DEX allows for direct peer-to-peer digital asset transactions to take place securely online without the need for an intermediary. DEXes typically use incentive mechanisms to acquire liquidity, then use smart contracts or order books for pricing. DEXes are unique compared to centralized exchanges (CEX) for three important reasons1:

· Security: when trading on a CEX, a trader must deposit funds into the CEX as collateral. This creates the need for the CEX to custody the digital assets and thus exposes the CEX to being hacked. With an immense amount of value in a centralized location, there is incentive for a hacker to steal the funds. This has happened numerous times during the history of the digital asset space. When using a DEX, a trader connects a wallet directly to the DEX protocol and does not transfer custody to a centralized entity.

· Transparency: fundamentally a DEX is a smart contract protocol written in code that executes orders based on that code. For DEXes, how the exchange operates is written into these smart contracts that run the DEX. These smart contracts can be audited and understood by any onlooker. Past performance and collateral levels can be analyzed to make sure the DEX has performed well during liquidity shocks. This leads to more transparency and trust.

· Global: the traditional financial system is siloed largely by nation. For example, the United States (US) has laws and regulations, with institutions and individuals acting within the bounds of those laws and regulations. An individual in France cannot open a bank and begin offering services in the US without registering with US authorities and obeying US laws. DEXes run on decentralized blockchains that can be used by anyone with a computer. It allows a trader in France to sell a digital asset to a buyer in the US without the two parties, or the DEX itself, ever knowing much of anything about each other.

Perpetual futures contracts: traditional futures contracts are derivative agreements to transact in an underlying asset at a specific date in the future. These contracts can then be standardized and traded in open financial markets.

For example, there is a futures contract on the price of oil with expiration one month from now. If the current price of oil is $65/barrel (the spot price) then the futures contract could trade at $70/barrel which would indicate market participants expect the price to rise over the next month. The spot and futures price converge as the contract nears expiration and the contract is settled based on the price at expiration.

What differentiates perpetual futures is that there is no expiration date. Perpetual futures function as never ending futures contracts that grant exposure (either long or short) to an underlying asset. In the traditional futures example above, the spot and futures price converge at the expiration date. With no expiration date, perpetual futures need a way to maintain the link between the underlying asset price (the spot price) and the perpetual futures price. Perpetual futures use a funding rate to do this. If the perpetual futures price is below the spot price, then the short positions pay the long positions a fee to maintain the link between the spot price and the perpetual price (and vice versa). This fee is paid at intervals (typically every hour or every eight hours)2.

Leverage is the other component of a perpetual futures contract. dYdX currently offers up to 25x leverage when trading perpetuals. Here is a quick hypothetical example to illustrate how it works:

· Bob is bullish on Ether (ETH) at $2,000 per ETH.

· Bob connects MetaMask wallet to dYdX and deposits $1,000 USDC.

· Bob uses the $1,000 to take a 2x leverage position representing 1 ETH worth of perpetual futures.

· If ETH does not drop below Bob’s liquidation price (~$1,000 per ETH in this example), Bob can theoretically maintain the position into perpetuity (in reality, fees would slowly erode the position).

There is an arbitrage opportunity that exists within the market structure that helps maintain the perpetual futures price peg to the underlying spot price.

For example, Bob buys 1 ETH spot then takes out a 1 ETH 1x leverage short position on dYdX. Bob now has a net zero position in ETH because the spot long is cancelled out by the derivative short. The trader is then only exposed to funding rate risk; if the funding rate is positive then the trader will collect risk-free profits from the short position while not being impacted by ETH price movements3. The higher the dislocation (difference between perpetual price and spot price), the higher the funding rate will be, and thus, the higher the incentive to arbitrage.

In summary, perpetual futures are derivative contracts that grant either leveraged long or short exposure to an underlying asset with no expiration date. To maintain the link between the underlying asset price and the perpetual futures contract price a fee is charged (funding rate) against whichever direction (either long or short) is causing the dislocation. Arbitrage opportunities help keep the perpetual futures price and spot price in check.

Layer 2: blockchains inherently face tradeoffs in how they will function. These tradeoffs can be thought of in terms of a trilemma between decentralization, security, and scalability. The theory is that in building a blockchain there can only be a focus on two of the three (making a tradeoff on the third)4. For Ethereum, the focus has been on security and decentralization (thus, sacrificing scalability). As the Ethereum ecosystem has grown, there has become an increasing need to scale usage to allow more transactions. If the network does not properly scale, then it becomes prohibitively expensive to transact which hurts the networks growth.

The term “layer 1” refers to the base blockchain, which in this case is Ethereum mainnet. To fix the scalability issue, “layer 2” solutions began to be built on top of layer 1. The introduction of these scaling solutions can be thought of as moving from everything being done on layer 1, to layer 1 becoming the settlement layer for layer 2 transactions5.

The transaction fees on the Ethereum blockchain are consistently prohibitively high. Thus, implementing a layer 2 solution can dramatically reduce the fees paid. This is done by abstracting transaction activity away from layer 1 to layer 2. Imagine instead of having to send every single transaction to the layer 1 blockchain, you could group 100 transactions together and send them all as one. This would allow more transactions per block and thus a more efficient blockchain (this is conceptually what layer 2 solutions allow).

The categories of scaling solutions include channels, plasma, sidechains, and rollups. Ethereum has been focused on rollups for its scaling solutions6. There are two types of rollups – optimistic and zero-knowledge rollups (zk-rollups). dYdX works with StarkWare and uses zk-rollups. StarkWare is an organization that creates scaling solutions for blockchains.

Zk-rollups: the two groupings of rollups are optimistic rollups and zero-knowledge rollups; the major projects using optimistic rollups for Ethereum layer 2 scaling are Optimism and Arbitrum, while zkSync and StarkWare are using zero-knowledge rollups.

With optimistic rollups, transactions are ordered and grouped by validators to be sent to the Ethereum layer 1 chain for final execution. Anyone on the network can participate as a validator, thus optimistic rollups rely on many validators doing similar work. These validators post an asset (Ethereum for example) as bond to the network. Any participant in the network can create a dispute if they think a transaction is false. To arbitrate the dispute, the transaction in question is run on the Ethereum layer 1 chain, if it is found that the transaction is false then the validator who sent the false transaction will have his/her bond slashed. There is typically a seven-day window to bring forth a dispute and the system only needs one actor to bring forth a dispute. Optimistic rollups are often referred to as “fraud proofs” due to the “innocent until proven guilty” approach of assuming transactions is true until proven false.

Zk-rollups rely on zero-knowledge proof cryptography which allows a “prover” to prove that a specific statement is true to a “verifier” without disclosing any details about the statement. In a zk-rollup, transactions are sent to the Ethereum layer 1 chain via a zk-proof which can then be verified. Due to the computational load of zk-rollups there is more centralization compared to optimistic rollups (as zk-rollups need more sophisticated hardware). With zk-rollups there is instant finality with no seven-day arbitration period7.

The major benefit of zk-rollups is fast finality while one of the downsides is being less Ethereum Virtual Machine (EVM) compatible. If a decentralized application (dApp) wants to run on an L2, they could do so on an optimistic rollup with limited adjustments to the code base. If a dApp wants to run on zk-rollup L2, much more work would need to be done. Thus, using zk-rollups leads to less composability.

The decision as to which layer 2 solution to build a dApp on will vary based on different use cases. dYdX chose to use zk-rollups because StarkWare (partner who focuses on zk-proof technology) had the ability to go-to-market quickly with a product, and the belief that composability isn’t as important for perpetual futures (dYdX focuses on building out their own technology stack). Optimistic rollups are more EVM compatible and thus lead to higher degree of composability because the code is easily altered/transferred.

Bringing these pieces together, dYdX offers perpetual futures that trade on layer 2 of the Ethereum blockchain. It does this using zk-rollup technology (built by StarkWare) that provides lower transaction fees and instant (final) transaction execution.

There are a few other important details crucial to understanding dYdX:

· Non-custodial exchange: a custodial exchange (centralized exchanges like Binance and FTX) requires control of the trader’s funds. dYdX (a non-custodial exchange) allows the trader to maintain his/her private keys and does not hand over custody of funds. To trade on dYdX layer 2, a trader simply loads USDC into a software wallet (ex: MetaMask), connects that wallet to the layer 2 exchange, deposits USDC into the layer 2 protocol, and then can trade/withdraw at his/her discretion (as illustrated in Bob’s example above).

· Market makers: these are professional organizations that dYdX partners with. They include Wintermute, Amber Group, WooTrade, Sixtant, and DAT Trading. Users of dYdX are incentivized to provide liquidity to dYdX in the form of USDC by being paid a reward in DYDX tokens for providing that liquidity. These market makers then borrow from the liquidity pool to buy and sell tokens on the dYdX protocol. Thus, these firms are providing necessary liquidity to users of the platform. The market makers are paid in DYDX tokens to incentivize the activity.

· Central limit order book (CLOB): dYdX uses an order book trade execution model. In this model, the exchange relies on an aggregated list of buy and sell orders submitted by traders for a given pair. Market makers use liquidity that is provided to the exchange to make markets. The bid-ask spread is the profit that market makers take for market making. This model is very efficient for liquid assets; the downside is that it is centralized and runs on servers like those offered by AWS.

The other model used by many DEXes is the automated market maker (AMM) model. In this model, liquidity is provided to a pool of two assets. The price fluctuates based on the balance between the two assets within the pool. For example, the pair is ETH/USDC; liquidity providers provide 50.0 percent of their funds to each asset and are rewarded for doing so (thus AMM’s rely on liquidity providers instead of market makers). The AMM then determines price based on a deterministic algorithm with the balance between the two assets in the pool being paramount8.

dYdX chose the CLOB model because it is used by centralized exchanges, thus market makers would be familiar with the model. dYdX also believes that CLOB’s are less capital intensive, requiring fewer funds to reach the same level of liquidity compared to an AMM9.

dYdX has stated the intention to completely decentralize the protocol as the protocol grows. Currently, dYdX provides the security and transparency of decentralized finance with the speed and usability of a centralized exchange.

Business Model:

dYdX collects revenue by taking a small fee on each trade made by a user. Specifically, dYdX uses a maker-taker fee model to determine fees. Within this model, there are two types of orders:

· Maker order: order that does not immediately fill; thus, goes to the order book and adds depth/liquidity to the market. An example of this would be a trader placing a limit buy order below the current price that is not immediately filled.

· Taker order: order that removes liquidity from the market by crossing an existing maker order.

The maker-taker fees vary by volume (see below). There is also the opportunity to receive discounts on fees for holding DYDX tokens.

dYdX Trading Inc. vs. dYdX Foundation: there is an important distinction that must be understood. dYdX Trading Inc. is the corporation that, in partnership with StarkWare, has built the layer 2 perpetual futures trading protocol that the DYDX token has governance rights over. The dYdX Foundation was created to be the governing body of the layer 2 protocol. The corporation (dYdX Trading Inc.) has the rights to the revenue that results from fees on spot, margin, and perpetual products. The DYDX token has governance rights over the layer 2 protocol and some incentives (currently reduced trading fees and soon safety staking). This structure is due to regulatory concerns.

DYDX token holders do not have the ability to vote into existence a revenue share or token burn model (at this time). dYdX Trading Inc. leadership has been adamant that the DYDX token is a governance token. To my knowledge they have not speculated as to whether a revenue share model will be implemented with any future regulatory clarity.

It is important to note that different decentralized finance governance tokens have experimented with different governance and tokenomics models. In attempting to build a decentralized exchange, it is important to maintain decentralization. This would be very difficult if the DYDX token were to be labeled a security in the United States and thus be subjected to strict regulation. It has been suggested that withholding the revenue from token holders will help to ensure the token will not be labeled a security under the Howey Test in the United States.

All this aside, in terms of revenue, dYdX has performed incredibly well, trailing only Axie Infinity in trailing 30-day revenue10.

Tokenomics:

In early August 2021 dYdX announced the DYDX token as a governance token for the layer 2 protocol.

Supply & Distribution: the total token supply is set to be 1.0 billion; 50.0 percent of that will go to the community and 50.0 percent will go to investors and past/future employees. Below is a detailed breakdown:

Here is a quick breakdown of dYdX stakeholders mentioned above:

· Layer 2 users: at the end of each epoch (an epoch being 28 days – the first epoch beginning on September 1, 2021) there is set to be a reward of 3,835,616 DYDX tokens paid out to traders on the layer 2 platform. This reward paid out at the end of each epoch will last for five years. The rewards are paid based on an individual users share of the total trading score during that epoch (the math is based on a Cobb-Douglas function). These rewards are a function of fees paid and open interest during the epoch.

· Past users: the initial token distribution to past users of dYdX was set to be 75.0 million tokens at the end of August 2021 (August 2021 representing epoch 0 with each subsequent 28 days being a new epoch). Of this 75.0 million set for initial distribution, only ~50.0 million were redeemed; the remaining ~25.0 million went to the community treasury (which the DYDX token holders govern). These rewards depended on the past usage of dYdX products.

· Liquidity providers: these are rewards paid to incentivize market makers to provide liquidity to the layer 2 protocol. At the end of each epoch, there is set to be 1,150,685 tokens distributed. To qualify, a market maker must have provided at least 5.0 percent of the maker volume in the preceding epoch. A proposal went through governance procedures to lower that threshold to 1.0 percent with the onset of epoch 3.

· Community treasury: this pool will vest over five years with control being given to holders of the DYDX token. A governance vote is required to spend any of these funds.

· Staking pool – USDC: this pool of rewards is to incentivize users to stake USDC that provides liquidity to the protocol. The approved market makers then borrow from this liquidity pool to further liquidity available across markets on dYdX (there is risk that these market makers are unable to pay back the USDC borrowed from the pool). Rewards are paid in proportion to total USDC being staked. These pay out each epoch over five years.

· Staking pool – DYDX: these rewards are paid to incentivize users to pool their DYDX tokens into a safety pool to create additional safety for the layer 2 protocol. This would act as a backstop if there were to be a liquidity crisis. When the DYDX token launched, there was an error in the smart contract for the safety staking pool. There is currently an ongoing governance vote to get the safety staking pool back online11. These pay out each epoch over five years.

· Investors, founders, employers (present & future): these are rewards granted to investors and employees for their contribution to the protocol. It is important to note that these tokens are locked up for the first 18 epochs (which is early 2023). These funds then vest over ~2.5 years with more vesting each month.

The result of the supply distribution is that only ~6.0 percent of the total supply is presently outstanding, while the expected inflation rate over the first 17 epochs (prior to investor and employee lock up ending) of 6.3 percent.

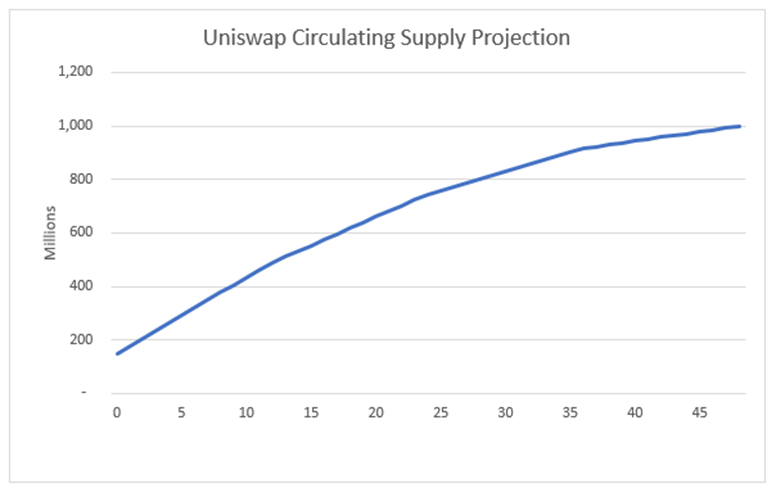

Uniswap Comparison: one of the main criticisms of the DYDX token as an investment is the supply (resulting in a high FDV). Uniswap offers a good comparison. Uniswap is an AMM decentralized exchange. In September 2020, Uniswap created and began to distribute the UNI governance token. Comparing the two shows the similarities with DYDX token.

Both UNI and DYDX tokens have 1.0 billion tokens to be distributed (with low inflation post distribution period). UNI came to market with 150.0 million tokens, while DYDX only 50.0 million initially. UNI also has a higher monthly inflation rate over the first ~17 months of token existence (based on projects of initial supply schedule).

The UNI supply schedule has not hindered the tokens value thus far. Below is a chart showing the price and volume growth since the UNI token inception.

This chart shows that the price of the UNI token appreciated once volume began to grow, and the price continued to appreciate as volume increased. This happened with the backdrop of more initial tokens in supply and a higher monthly inflation rate as compared to the DYDX token. It is fair to note that the UNI token allows the right to vote fee sharing in the future while the DYDX token does not.

If successfully reinstated, the safety staking pool would grant DYDX token holders the opportunity for a staking yield for the next five years. This provides utility for the DYDX token.

DYDX Token Governance & Incentives: the DYDX token grants governance rights to its holders. These rights include irreversible control over:

· Allocating community treasury funds

· New token listings on layer 2

· Risk parameters for layer 2

· Capital allocations to market makers in liquidity staking pools

· Adding new market makers to liquidity staking pools

· Determining safety staking payouts if losses incur

· Governance contracts

While the DYDX token does not entitle the holder to a share of the layer 2 protocol fees, it does grant fee reductions based on the amount of holdings. The more DYDX token a user holds, the higher the percentage discount on fees that user gets. The exact breakdown is below:

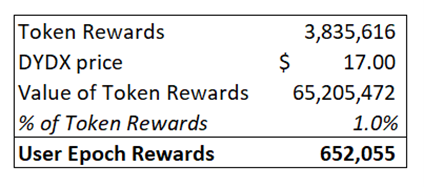

This fee discount, in tandem with the reward distribution, set a powerful set of incentives to drive adoption and volume growth. Here is an example from epoch 1 which ended on September 28, 2021. There was ~$35.0 million paid to the layer 2 protocol in fees during the epoch12. Assuming a user paid 1.0 percent of the fees, that user paid almost $350.0 thousand in fees. According to the fee discount table above, that user could qualify for up to a $175.0 thousand saving:

This user would also be entitled to rewards based on trading activity during the epoch. Given the token rewards of 3.8 million and a market price of $17 per DYDX token, this user would claim almost ~$650.0 thousand in value for trading on the platform.

This is a hypothetical example that helps to show the power of incentives driving dYdX growth. In the Competition section there will be more detail about incentives being offered by direct competitors.

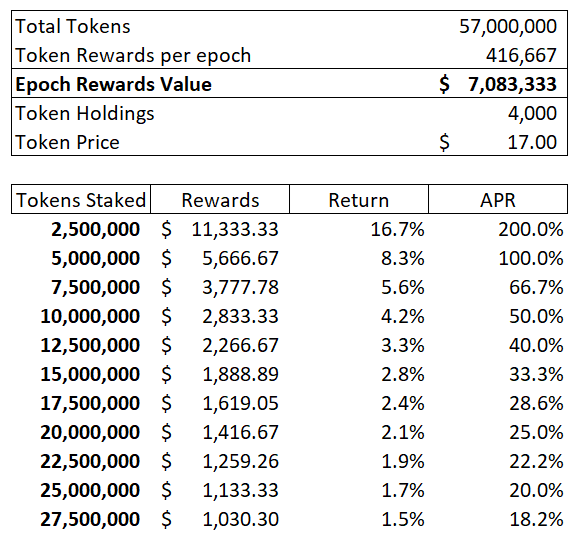

dYdX Staking: once reinstated, the dYdX token can also be staked into a pool that provides an additional capital backstop for the protocol. This functionality was introduced at the beginning of epoch 1 but had an error that needed to be fixed.

These rewards are set to be 25.0 million tokens distributed over five years. Assuming equal distribution over that timeframe, that is 416,667 tokens per epoch.

If the price of dYdX is at $17, then the monthly staking rewards are ~$7.0 million. If a user stakes 4,000 tokens and 10.0 million of the ~57.0 million in circulating supply are staked, then that user could achieve a 50.0 percent APR. This will fluctuate based on how many tokens are staked but the annualized return should prove high enough to cause many to stake their coins.

Looking to Perpetual Protocol, a direct competitor of dYdX, ~28.4 million of the 55.7 million circulating supply are staked in the safety fund. This represents an APR of 27.5 percent13. It is reasonable to assume that a similar proportion of the circulating supply will be staked when the safety staking contract goes live.

It is important to note that once staked, the tokens must be staked for the entire epoch and can be removed at the end of that epoch.

To summarize, for dYdX and competing decentralized derivatives platforms, there is an important feedback loop for the token:

· Token price increases

· Leads to increased awareness

· Value of trading incentives increases helping create more trading volume

· Staking creates further utility for the token; brings token supply off market

· Token continues to appreciate as trading volume increases

Opportunity:

The derivatives market for the digital asset space has been growing rapidly. In Q3 2021, the perpetuals market grew at 418.0 percent year-over-year (YoY) to $13.43 trillion in volume. The total volume in Q3 being lower than in Q2 is to be expected given that July and August are typically the slowest months of the year in financial markets14.

The perpetuals market has exploded to encompass half of the total volume (both spot and derivatives combined) done in the digital asset industry.

Most volume (both spot and derivative) is done via centralized exchanges (CEX). For example, decentralized exchanges (DEX) did ~2.0 percent of spot volume in Q2 2021. Prior the launch of the DYDX token and the explosive growth that the layer 2 dYdX protocol showed in the month of September 2021, no decentralized perpetuals protocol had gained much steam.

Decentralized perpetual futures market: dYdX has dominated the DEX perpetual futures market since launching the DYDX token. In the last two weeks of October, Arbitrum began gaining volume following the launch of a large incentives program15.

Decentralization & Regulation: there is a strong catalyst behind the shift from CEX perpetual futures trading to DEX perpetual futures trading. The power of this shift has already displayed itself in the surge in dYdX volume at the end of September and into October 2021.

· On September 26, 2021, Huobi (the fourth largest derivatives exchange by open interest) released a statement that stated they will be retiring Chinese users through the end of 2021 in response to the most recent round of crypto crackdowns from the Chinese Communist Party16.

· This news led to a surge in Chinese interest in dYdX as evidenced by search trends for “dYdX” in China.

· The result was an explosion in usage of the platform with dYdX 24-hour volume reaching nearly $10.0 billion in volume (placing it in the top 5 for all exchanges – including CEX – in this metric).

This surge in volume is also attributable to the end of epoch 1 on September 28, 2021. As mentioned above, the trading rewards are a huge incentive to drive volume growth.

The recent example from China is not the only regulatory tailwind for DEX trading:

· In the United States, new SEC chairman Gary Gensler has an aggressive policy agenda that includes attempting to bring the digital asset industry under his administrations purview. In recent remarks during a Senate Finance Committee hearing, and in an interview with the Washington Post, Gensler compared the cryptocurrency industry to the “Wildcat Banking” era (a time from 1836 to 1865 in which the US had no national currency; money was issued by state-charter banks). Gensler has referenced two Supreme Court cases for legal precedent that he says allows the SEC to categorize many digital assets as securities. Agree or disagree, there is a regulatory turf war in the US and increased pressure from progressive Democrats like Elizabeth Warren.

o This has led even DeFi projects to attempt to protect themselves. Recently 1inch (a DeFi project) added geolocation to their UI in which a user must pledge not to be in the US. In subsequent weeks, other DeFi projects have followed this example.

· Binance, the largest exchange in the world, has not allowed US users since 2020 (but has rather created a watered-down US specific product). That said, it has been possible to use a VPN to get around this ban given that historically there have not been know your customer verification. This is changing with Binance mandating user verification for not only new but also existing users in October 2021.

· FTX, another popular exchange, requires verification to use its main platform. FTX has created FTX US specifically for US users, but the functionality is limited to appease US regulators.

The important takeaway is that there is increasingly a need for decentralization across jurisdictions. Access to many digital assets and digital asset products is being limited by unclear regulation and/or stern regulation.

Competitors:

dYdX is the first decentralized derivatives platform to gain significant traction in the market. While dYdX competes with centralized exchanges like Binance and FTX for derivatives volume, the main competitors are other decentralized derivatives exchanges. The competitors include Perpetual Protocol, MCDEX, GMX, FutureSwap, and Mango Markets. Other more nascent exchanges to pay attention to in the future include DerivaDEX, Injective, Bonfida, and Drift (among others).

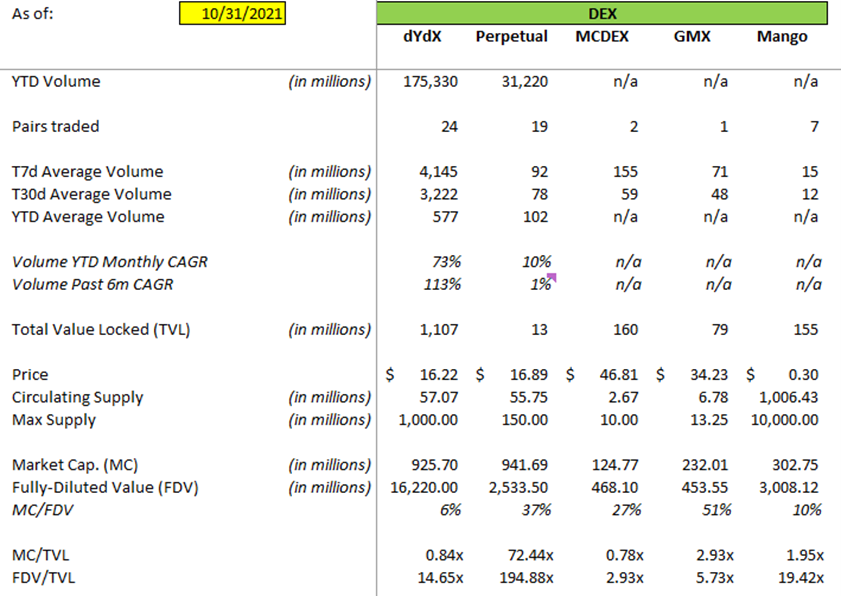

Below is a comparison between these competitors17 18:

The primary benefit of a CLOB model is the ability to offer more sophisticated order types (limit orders, stop-loss, etc.); the downside being centralization. The vAMM model builds off the AMM model by bifurcating the trading liquidity from the AMM itself. In the vAMM model, the liquidity is stored in a vault and the vAMM itself acts as a price engine. vAMMs allow traders to know the price since there is no counterparty (market maker in CLOB model) and no taker fees19.

Competition is heating up, and while dYdX provides a trading experience like centralized exchanges like Binance and FTX with decentralized benefits, there is no certainty in which model wins. Incentives and tokenomics are instrumental in attracting traders in the early stages of development.

Trading Incentives: dYdX token incentives model has been successful in attracting volume to the protocol. The value that is paid out in the form of DYDX tokens often offsets the amount of fees paid in each epoch for a trader.

Perpetual is using a referral program to build protocol volume. This could change with the incoming launch of v2 of the protocol.

MCDEX is distributing 300,000 tokens to traders during Q4 2021 at a decreasing pace each week. This has been effective in driving volume as MCDEX builds on Binance Smart Chain (BSC) and Arbitrum.

FutureSwap is just getting going on Arbitrum after pivoting from Ethereum mainnet to the layer 2 solution earlier this year. FutureSwap is paying out high rewards, but traders must vest and wait a year to claim 100.0 percent of their rewards.

Value Accrual: the DYDX token is a governance token that does not have the rights to cash flows from the layer 2 protocol. Once the staking pool is restarted, there will be the option to earn yield by staking DYDX tokens for five years. The lack of a cash flow element is certainly a risk to DYDX token as an investment.

Perpetual Protocol (PERP) grants 50.0 percent of trading fees to token holders; the other 50.0 percent goes to the insurance fund to backstop the protocol. In addition to this, Perpetual rewards stakers with 150,000 per week which puts PERP staking rewards in-line with DYDX.

While MCDEX does not provide direct rewards for staking, staking MCD helps to boost “trading score”, which is the measure by which trading incentive rewards are distributed. The MCD token can be earned by providing liquidity to the protocol to be used as trading collateral.

GMX is arguably the most unique in design. 30.0 percent of fees are converted to ETH and distributed to GMX stakers, while the other 20.0 percent goes to the “floor price” fund which effectively buys back GMX tokens if they drop below a certain level. The remaining 50.0 percent of fees go to GLP token holders; GLP is the liquidity provider token for the protocol.

FutureSwap and Mango Markets are interesting in that they do not have set tokenomics but are rather building out the protocol then letting governance decide.

Valuation/Comparison:

The digital asset space does not seem to trade based on fundamental analysis. That does not mean that strong projects with good fundamental value are not successful but rather that trying to use fundamental drivers to determine if a project is under or overvalued based on a sense of intrinsic value is tough. That said, I will look at certain relative valuation multiples to try to understand the market.

When analyzing dYdX, volume and total value locked (TVL) are the two most important metrics. How these metrics compare to other decentralized exchanges gives insight into the state of the market.

Looking first at trading volume growth rates, dYdX has exploded since beginning the launch of the DYDX token in August 2021. Perpetual has experienced meager growth during the same time frame but will soon launch v2 of their protocol20. MCDEX recently launched on BSC and Arbitrum with strong incentives but due to the recency of the launch it is not possible to compare growth rates21. GMX recently launched on Arbitrum and is building volume. Mango Markets volume data was only available for the past month22.

Comparing the ratio of total value locked (TVL) to the market capitalization (MC) and fully diluted value (FDV) is useful to understand how the market is valuing each protocol on a relative basis. Looking at the MC/TVL ratio, dYdX and MCDEX appear undervalued relative to the peer group. It is important to note the Perpetual’s TVL is not apples-to-apples given the protocol uses trader collateral as liquidity instead of requiring liquidity providers. This results in a lower TVL figure for Perpetual. Looking to the FDV/TVL ratio, MCDEX stands out as undervalued. Due to the high total supply of DYDX tokens, dYdX has a much higher multiple.

Market capitalization-to-average daily volume multiples are the best way to compare dYdX to other protocols given the fact that dYdX does not earn revenue. Looking to the trailing 30-day volume multiples, dYdX trades at a significant discount to peers. This is especially pronounced when looking at the MC multiple of 0.29x compared to Perpetual at 12.08x. Due to dYdX’s high total supply, the disparity is less striking but dYdX still trades at a significant discount. Further, if those multiples are growth adjusted, dYdX is trading at pennies to Perpetual’s dollar. Growth multiples for MCDEX, GMX, and Mango are not calculated due to insufficient volume data to calculate growth rates necessary for the calculation.

There are three important factors to understand dYdX’s relative undervaluation. First, the market could be signaling that FDV is what is most important. Given that dYdX has a much higher FDV with much more DYDX token supply to come online, the market could be severely discounting dYdX. Second, the DYDX token does not have as good of tokenomics as competitors. Further, the staking pool has been down so the DYDX token has been effectively useless outside trading fee saving. Lastly, looking to the perpetuals market, it appears the DYDX token has consistently had a higher volume of shorts compared to longs23. This could be weighing down the DYDX token as traders bet against the token, or hedge market risk against long positions in other tokens.

Community:

Fostering a healthy community of users, contributors/founders, and investors is important for a protocol to succeed.

Social Media: one way to compare the health of an ecosystem is to measure social media engagement based on the number of users. Across Twitter, Discord, and Reddit, dYdX has over three times the number of users compared to comparable protocols. This is positive for dYdX and reflects the strong community being built.

Investors: dYdX most recently raised $65.0 million in a Series C financing round in June 202124. Investors in dYdX include venture capital firms Andreessen Horowitz, Polychain Capital, Dragonfly Capital, and Three Arrows Capital. In addition to the superstar VC firms who have invested in dYdX, some of the most prominent individuals in the digital asset space have also invested including Brian Armstrong (CEO of Coinbase) and Naval Ravikant (founder of Angel List).

Founder: Antonio Juliano studied Computer Science at Princeton University in 2015 before beginning his career at Coinbase as a Software Engineer. Antonio started dYdX in August of 2017 and has been involved in the digital asset space for over five years25. Antonio has now been working on dYdX for over four years, having led the growth from zero to billions of dollars in trading volume.

Risks:

the three main risks for dYdX are regulation risk, protocol risk, and competition risk.

Regulation Risk: In the United States, the Infrastructure Investment and Jobs Act (INVEST bill) passed in both the House of Representatives and the Senate. There are two important changes to the US tax code in this legislation:

· Section 6045 of Internal Revenue Code: the INVEST bill expands the definition of a broker to be “any person who is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person”. These “brokers” must report information about people involved in transactions to be submitted to authorities. The problem is that the definition leaves the term “broker” far too vague and that complying with the legislation is effectively impossible26.

· Section 6050l of the Internal Revenue Code: the INVEST bill requires recipients of digital assets valued over $10,000 to report the sender’s name, address, and Social Security number to the government. The punishment for violations is a felony (unlike all other IRS information reporting requirements) and applies broadly to “any person” who receives digital assets27. This is entirely incompatible with decentralized finance given that in most instances, participants do not know who exactly they are interacting with (that is the point).

Both amendments to the Internal Revenue Code are set to become law January 1, 2024. Thus, there is still time for further amendments and potential court challenges. In their current form, these amendments would pose significant risk to decentralized finance in the United States.

Protocol Risk: as with all protocols in the digital asset space, there is the risk that the code is exploited by malicious actors. The governance and token contracts are forks of the AAVE governance contracts audited by CertiK, Certora, and Peckshield (also tested live on mainnet). All new smart contracts are audited by Peckshield[4].

Competition Risk: a new or existing competing protocol could win significant market share that could hinder the prospects for dYdX. This could happen due to superior product, better trading incentives, or better tokenomics.

Important Events/Catalyst:

The DYDX token lagged competitors in October 2021 following strong performance during September post token launch.

These are the important events on the horizon that could impact the DYDX token:

DIP 3 – Safety Module Restoration: there is an ongoing vote that ends on November 12 to restore functionality of the Safety Module that allows users to stake their DYDX tokens to backstop the protocol in return for DYDX token rewards. The proposal has met the necessary 100.0 million DYDX token quorum and currently is on track to pass28. As indicated in the analysis above, this will bring millions of tokens off the market and into the staking pool; concurrently it should drive demand for the DYDX token given the status of the dYdX project within the digital asset space, and the attractive APR.

The proposal is subject to a 7-day time lock after the end of the voting period. This would mean the staking protocol could go live on November 19.

Mobile trading application: the dYdX team has been working on a mobile application for trading that would represent a huge step forward. The team recently stated that the expected launch should be within 2-4 months29.

zero-knowledge proofs: there could be significant focus on protocols deploying zkp technology. zkSync just raised $40.0 million in VC funding and StarkWare continues to produce high quality projects. If zkp technology proves effective it could dominate Ethereum scaling.

https://www.realvision.com/shows/the-interview-crypto/videos/dydx-building-the-future-of-dex-margin-trading

https://www.delta.exchange/blog/what-are-perpetual-futures-contracts-beginners-guide/

https://academy.shrimpy.io/post/what-is-the-blockchain-trilemma

https://medium.com/the-capital/layer-1-vs-layer-2-what-you-need-to-know-about-different-blockchain-layer-solutions-69f91904ce40

https://cryptonews.com/news/vitalik-buterin-pushes-for-rollups-as-ethereum-s-scaling-sol-6996.htm

https://ethereum.org/en/developers/docs/scaling/layer-2-rollups/

https://blog.injectiveprotocol.com/decentralized-exchange-designs-order-book-model-vs-automated-market-maker-amm/

https://phemex.com/academy/what-is-dydx

https://www.tokenterminal.com/

https://dydx.community/dashboard/proposal/3

http://metabase-1818188965.us-east-1.elb.amazonaws.com/public/dashboard/b3e36e1f-6860-4ecb-8f8b-96ca727f4609

https://staking.perp.exchange/

https://image.tokeninsight.com/levelPdf/TokenInsight_2021_Q3_Crypto_Trading_Industry_Report_compressed_2.pdf

https://www.binance.org/en/blog/100m-liquidity-incentive-first-recipients-awarded/

https://www.huobi.com/support/en-us/detail/54886961978434

https://messari.io/article/marty-mcfly-goes-defi-an-overview-of-decentralized-futures-exchanges?referrer=asset:dydx

https://medium.com/@vikram.arun/gmx-the-trading-platform-of-the-people-by-the-people-for-the-people-c4856897478

https://www.coingecko.com/en/exchanges/perpetual_protocol#statistics

https://www.coingecko.com/en/exchanges/mcdex_bsc#statistics

https://mango.metabaseapp.com/public/dashboard/e312fbc8-9507-458c-a0e4-fb882c36b0d6

https://www.coinglass.com/

https://dydx.exchange/blog/series-c

https://www.linkedin.com/in/antoniojuliano/

https://www.cryptonary.com/infrastructure-bill-with-crypto-tax-provisions-knocks-the-doors-of-the-oval/

https://www.proofofstakealliance.org/wp-content/uploads/2021/10/Research-Report-on-Tax-Code-6050I-and-Digital-Assets-printable.pdf

https://dydx.community/dashboard/proposal/3

https://dydx.foundation/blog/en/epoch-2-community-ama