Thoughts on Music NFTs

Here is the link to the original post on Medium: https://medium.com/stateless-ventures/thoughts-on-music-nfts-2b47d5428af

It is often said that a picture is worth a thousand words. In regards to the evolution of the music industry over the past five decades, I can think of no better way of describing the changes than showing the below picture.

The CD became the dominant format for music consumption in the 90’s. Then, the industry began to digitize; led by the advent of the Apple Music Store and the Ipod. Over the past five years, a new business model has taken over the music industry — paid subscription streaming. This business model has helped the music industry grow to heights not experienced since the turn of the millennium. So what is the issue?

The problem is that the artists themselves (the creators of the actual music) are only seeing a fraction of that. For context, an extensive CitiGroup report noted that in 2017 artists received only 12.0 percent of the music industry revenue. This trend has persisted while streaming platforms — namely, Spotify and Apple Music — who aggregate supply (artists’ music) and demand (consumers of that music) have captured an increasing share of industry revenue.

It is true that as Spotify’s revenue grows, so does the amount of total royalties paid out to artists. That said, looking at statistics Spotify publishes on artist revenue paints an interesting picture. In 2020, Spotify noted that of 8.0 million artists on the platform, only 13,400 made at least $50,000 in streaming royalties revenue ($50,000 being the approximate median salary in the United States); Spotify notoriously pays $0.003 per stream. Further, only 870 artists made over $1.0 million from streaming royalties.

There are many things in life that adhere to a power law distribution of outcomes; music streaming being one of them, given that the top 57,000 (out of 8.0 million) artists account for 90.0 percent of streams. While that may always be true to some extent, I think there are two takeaways that are difficult to argue against:

Music is a profound human experience; humans love listening to music. A large number of human beings enjoy creating music (on Spotify alone that number is about 8.0 million). A very small percentage of these artists are able to make a living via the music they create.

Record labels, streaming platforms, and other middlemen take most of the revenue derived from the industry as a whole. Most of the artists see very little of the total pie.

There have been attempts to apply blockchain technology to the music industry over the past decade. These were valiant efforts and largely lessons for others to build upon. Once NFTs exploded in 2021, users and entrepreneurs increasingly began to experiment with how this new technology could help solve the issues outlined above.

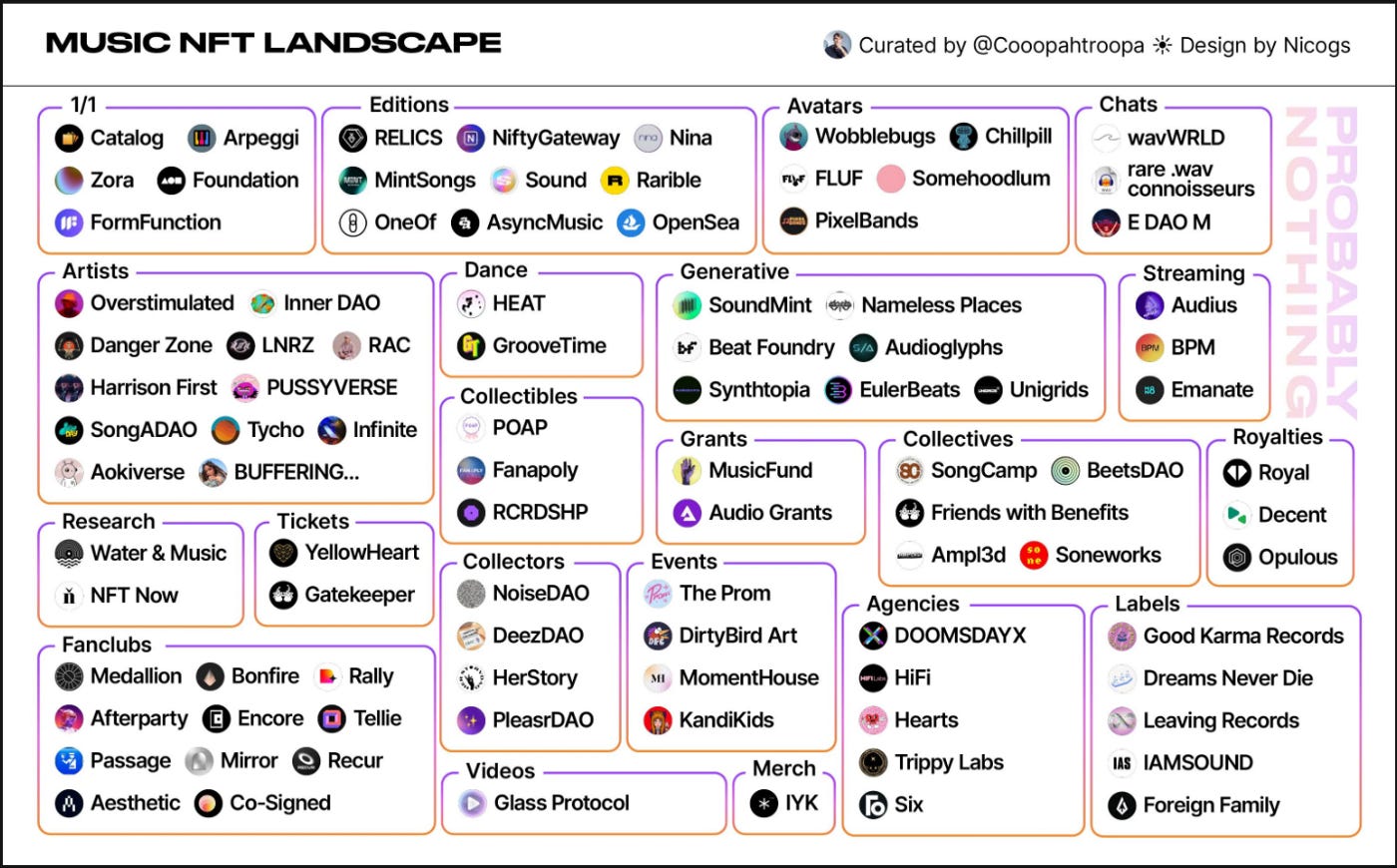

Music Landscape — web3

For those totally unfamiliar, a music NFT is a fixed quantity, tokenized audio file (in the form of .mp3 or .wav file type). Typically, music NFTs do not come with inherent rights (ownership, royalty rights, publishing/licensing rights, etc.); there are a couple projects creating NFTs that have ownership over royalty fees (more on this later). Social tokens, NFT tickets, DAOs, and steaming protocols are also part of the web 3 music ecosystem.

Recently, there has been a proliferation of projects working in the web 3 music space. The below chart is the best attempt I have come across to visually map, and compartmentalize, the space.

As the map above indicates, there is a ton going on in the music NFT ecosystem. Let’s take a look at a few frameworks to better understand the landscape.

Frameworks

Platform vs. Protocol

The best way to understand the difference between the platform and protocol approach is to look at examples of each.

Sound.xyz is a platform that allows an artist to mint collectable NFT versions of their songs. Typically, for each song there are 25 NFTs priced at 0.1 ETH each; all 25 of these NFTs are the same song and do not have rights of any kind (royalties, licensing, publication). For NFT mints, Sound does community listening parties to get the community excited about the mint. The platform also attempts to create social dynamics. The owner of each music NFT can comment on that specific NFT version of the song; this comment is public. Once the NFT is sold, the new owner can replace the old comment with a new comment, and the process repeats. Sound raised $5.0 million in seed funding from a16z and has enabled artists to raise over $2.0 million via their platform.

Within our framework, Sound is a platform in that it has a strict functionality. That being a place for artists to fund their work by selling collectable music NFTs to fans.

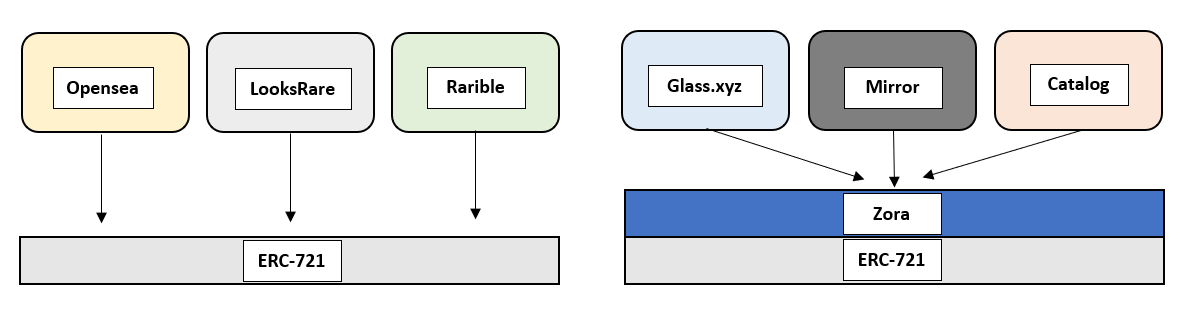

Zora looked at the space and decided to take a different approach. The Zora team noted that as NFT marketplaces/infrastructure began to take shape, creators were facing issues similar to those from web 2 era platforms — exclusive creation, proprietary royalties, and platform fees. What if, instead of building a platform using existing standards (like OpenSea, for example), there was a purpose built protocol layer that allowed others to create their own platforms? This is the vision for Zora. To do this, the Zora protocol effectively acts as an extension of ERC-721 (the token standard for NFTs) that embeds features (for example, royalties and perpetual auctions) directly into the smart contracts. This allows other projects to build on Zora, using the Zora protocol.

Zora uses the below depiction to compare the platform (application) and protocol approaches. This visualization is based on the “Fat Protocol” thesis from Union Square Ventures. The idea is that in web 2 the application layer captured most of the value, and in web 3 the protocol layer will capture most of the value.

Zora co-founder Jacob Horne recently published a piece titled Hyperstructures in which he defines a new paradigm for crypto protocols. Hyperstructures are, “crypto protocols that can run for free and forever, without maintenance, interruption or intermediaries”. In order to be a Hyperstructure, a protocol must be:

Unstoppable: the protocol runs for as long as the underlying blockchain exists

Free: protocol runs exactly at gas costs

Valuable: accrues value to owners

Expansive: built-in incentives for participants in the protocol

Permissionless: universally accessible and censorship resistant

Positive sum: win-win environment

Credibly neutral: user agnostic

With v3 of the Zora protocol, Zora is building a Hyperstructure for NFTs. Projects already built on Zora include: Glass, Catalog, and Mirror.

It is still very early days for music NFTs and the ecosystem is in need of web 3 native infrastructure that will enable use cases unique to blockchain technology. Thus, I think the protocol approach could prove important and allow for the creation of a web 3 native music ecosystem (DAOs as record labels, content creation on the protocol, etc.).

Everyday Use vs. Collectables

Audius fits sternly within the “everyday use” category.

Audius has become one of the most successful web 3 music projects and has an impressive list of investors (including artists such as Jason Derulo and Steve Aoki). The project is typically described as, “web 3 Spotify”. Audius allows artists to upload music that users can then stream (listen to), just like Spotify. It uses the $AUDIO token to incentivize usage (for example, creation/curation of playlists), while giving artists the opportunity to own the platform they post their music to; 90.0 percent of the platform’s revenue goes to artists, which ideally allows them to earn more per stream compared to web 2 competitors.

Audius had over 5.0 million monthly active users in August 2021, and has approximately 4.5 million over the past month.

To better understand Audius’ potential growth, it is important to understand the industry. How the music industry works is an artist signs a deal with a record label (typically for a certain number of albums), then that record label handles distribution of those albums for the artist (record labels also provide other services for artists). There are three major record labels (Universal Music Group, Sony, and Warner Music Group) that largely own the rights to studio albums for most major artists. Thus, for example, when Spotify wants albums by Drake, Imagine Dragons, Halsey, and J. Cole on their platform, they must negotiate a distribution deal with Universal Music Group. So, in order for Audius to have Drake’s music on their platform, Audius would have to go to Universal to sign a similar deal to Spotify’s. This strategy is difficult for a decentralized protocol with limited resources.

As a result, Audius is currently focused on being more complimentary than competitive. While studio albums are the music most of us hear from our favorite artists, these artists are creating many songs that do not end up on these albums. Artists also typically lack effective mediums for engaging with their most passionate fans (fans who would love to listen to songs left off of the album). This is where Audius sees its potential to create a platform for artists to stream these “mixtape” songs to fans. Avid fans get the opportunity to listen to music they would normally not get the chance to, while also financially supporting these artists in a more direct fashion. Artists get the benefit of another revenue stream, while also creating a more direct relationship with fans. In this way, Audius can become the de facto “fan page” for artists.

Audius could also focus on growing their platform via aggregation of many smaller “indie” artists (those artists who do not have record deals). The platform (Audius) could potentially gain leverage and disrupt the industry from beneath the large players; this is a form of Clayton Christensen’s idea of “disruptive innovation”. The problem is, as noted above, the major artists receive 90.0 percent of the attention (projects like SoundCloud are struggling to survive).

At the other end of the spectrum, rare collectibles are similar to Audius in that the music can be streamed repeatedly, but differs in that each music NFT has built in rarity. The example of Sound.xyz above is one example of this idea.

While there are projects creating unique one-of-one collectable music NFTs (for example, Catalog), a popular model that is being experimented with is a tiered approach. Pianity is a great example of this type of collectable form.

Pianity allows artists to mint their songs as music NFTs with four levels of rarity — Rare, Epic, Legendary, and Unique.

This tiered approach allows artists to capture more of the value out of the demand curve. Each artist is going to have a spectrum of fans, ranging from passionate (who might spend thousands of dollars on a 1/1 NFT) to casual (who are more likely to purchase a cheaper NFT). By being able to better serve their spectrum of fans, artists can better support themselves without millions of fans (see Chris Dixon’s essay NFTs and a Thousand True Fans).

The music NFTs do not entitle the owner to any royalties from the song; they are entirely collectable in nature. These NFTs are very similar to sports trading cards in the physical world. Both are not inherently valuable financially, but allow fans to collect memorabilia, be it physical or digital.

Each season, sports cards manufacturers (for example. Topps) make a new “set” of cards for that season (for example, 2022 NFL Topps cards), that is composed of current players. For each player in the set, there is a base card for that player, and “rare” cards. Here is an example of how it works:

For sports cards, “rookie cards” are typically the most valuable. Rookie cards are from a given players’ first season in the league. For example, the year 2000 Topps Tom Brady rookie card is worth far more than the year 2022 Tom Brady card (even more so if the rookie card has rarity, as portrayed in the example above). The value accrual for the sports card industry results in the cards for the legends of the sport (for example, Tom Brady, Aaron Rodgers, and Peyton Manning in football) gaining most of the value. Thus, rookie cards (and some special feature cards, like on-card autographs) for these legendary players capture most of the total secondary market value for the entire industry.

I think that sports cards show the potential for purely collectable music NFTs. In the same way rarity matters for sports cards (1/1 is far more valuable than 1/100,000), rarity will matter for collectible music NFTs. In the same way rookie cards are most valuable, the early song/album music NFTs for an artist who achieves success will be most valuable. In the same way the legendary player cards are most valuable, the future legendary musicians who mint collectable music NFTs will also be valuable. Imagine owning a rare edition of Beyonce’s first popular song (her “rookie card”) minted as an NFT.

Revenue Generating vs Collectable NFTs

Another way in which music NFTs can be grouped is revenue generating music NFTs (NFTs that accrue royalties) and collectables (as was discussed in the previous section).

Record labels are effectively venture capital funds, they make a number of small investments in artists by signing them to deals. A record label will sign ten artists, eight or nine or them will likely “fail” (defining fail here as not becoming commercially successful); the hope is that one of the ten is Beyonce or Lady Gaga. In recent years, as music catalogs from prominent artists have garnered big money (Bob Dylan sold the rights to his recorded music catalog to Sony for $150.0 million in 2021), record labels have literally become venture capitalists (partnering with large financial institutions to create funds to invest in music rights). Clearly, music rights have become an investable asset class and, as an asset class, are attracting large pools of capital.

There are two interesting web 3 native projects that are allowing artists to sell rights to future royalties in NFT form — Royal and Decent.xyz.

The idea is pretty simple; an artist can sell NFTs that represent a percentage of future royalty revenue for a specific song. This allows the artist to raise funding to support their work without having to sign to a major label, while also giving fans the opportunity to directly invest in an artists’ work.

Royal has raised over $50.0 million in venture funding from the likes of a16z, and has had prominent artists launch NFTs on their platform (including Diplo and Nas). On Royal, an artist mints royalty-backed NFTs for a specific song. There are typically three tiers: Gold, Platinum, and Diamond.

Each tier represents a larger ownership percentage of the royalties and, in addition, progressively more perks/access to the artist. Each tier costs more than the previous, and there is lower supply.

When an asset has direct financial value (i.e. it receives cash flows), it tends to be mathematically valued and subsequently the assets trades based on a valuation process (for example, a discounted cash flow analysis). I did a discounted cash flow analysis for Diplo’s Don’t Forget My Love (see Appendix); my takeaway is that the song will need to do ~450.0 million total streams across Spotify, Apple Music, and Amazon Music over the next 10 years to roughly breakeven on the investment. Given market share, at least half of the total streams need to come from Spotify. On Spotify, it appears Diplo has five songs with at least 200.0 million streams. Thus, using this back of the envelope math, the song would need to be one of his most popular. What will be interesting is how much value fans/investors place on the benefits of holding the NFT (concert tickets, memorabilia, etc.) regardless of financial analysis.

Decent.xyz provides the same product as Royal (music NFTs that entitle the owner to a percentage of royalty streams) but with a few changes. First, NFTs on Decent are for short periods of time (typically, three years). Second, rather than focusing on major artists like Diplo, Decent is focused on the long-tail of small artists. A typical mint on Decent will be for 30 NFTs, each entitled to approximately 1.0 percent of royalties; each being priced at 0.1 ETH. I did an analysis for a recent Decent mint (see Appendix).

What appears to be the first use case of royalty music NFTs is the ability for new/unknown artists to effectively crowdsource financing for their careers. Creating a world in which artists are not entirely reliant on getting a record label deal. With the NFTs only entitled to streaming royalties for three years on Decent, it also gives the artists future flexibility.

The big risk for music NFTs that grant ownership to royalties is that they look alot like a security contract. This could potentially place them under regulatory scrutiny.

Music Creation Tooling

For digital creators there is a huge issue with attribution for digital content. For example, a music producer creates a beat for an EDM song and it gets posted to SoundCloud. Another artist discovers the beat, samples it, and uses parts of that beat for their own new song. That song ends up becoming a major hit; the producer who made the original beat does not get attribution. The issue is, there has not been a proper technology to keep track of digital ownership. Enter NFTs…

Arpeggi is in the process of building Arpeggi Studio, the first fully on-chain creative music platform.

Arpeggi Studio is an in-browser digital audio workstation where users compose and mint their own songs (as NFTs) directly on the blockchain. When an artist mints their composition, an immutable copy is stored on the blockchain and owned by its creator (no middleman).

In the future, using this technology, the music producer from our example above could use Arpeggi to create his EDM beat, mint that beat on the blockchain as an NFT; and in doing so, could track its usage and have attribution for his/her creation.

I think that NFTs will allow digital creators of all sorts to maintain and track ownership of their digital work. This should create another avenue for these artists to capitalize on their labor not currently present.

Asynchronous Art (Async) is another project that allows creators to mint NFTs, with a twist. Async introduces a unique model that enables variation in the music NFT output. There is one “master track” NFT that is composed of stems (which are individual NFTs themselves). Each stem has up to nine variants; the owner of each individual stem gets to select the variant. The compilation of these selections makes up the master track at any given point in time. This effectively allows for the open-source of continuous remixes for a given song.

Artist to Fan Connection

A common thread throughout the music NFT landscape is the ability for the artist to have a more direct relationship with their fans. The current web 2 landscape is incredibly fragmented and artists often do not have direct to consumer relationships (ticketing is done by TicketMaster and StubHub, events are put on by Live Nation, streaming on Spotify, etc.).

Creating and bringing communities together is a powerful feature enabled by NFTs. There are numerous fanclub and social token-like projects in the early stages of creation in web 3. What is interesting to monitor for projects building platforms in this space is: how projects able to help artists create direct relationships with fans, and can these platforms help reduce the fragmentation, thus, making it easier for artists to manage fan relationships. I get the sense that artists would much rather spend time creating as opposed to what amounts to administrative work. Put differently, do artists really want to manage their own fan relationships? I think it will depend on the artist and the medium (what that artist is creating).

Crazy Ideas That Could be the Future

Miquela DAO

Miquela Sousa (Lil Miquela) is a digital persona who has gained significant notoriety (over 3.0 million Instagram followers). Miquela is a CGI character who lives out a fictional narrative on her Instagram account (including music videos). As CGI and artificial intelligence technologies progress, it stands to reason that more characters like Miquela will be created.

The idea: a DAO of music producers forms to create songs and albums. Instead of selling those songs and albums to “real” artists. The DAO creates a digital character (like Miquela) that performs the music (the digital character is the musician). Members of the DAO would have ownership and voting rights over the music created and how it is performed. The digital artist could live digitally, forever (no sick days; no breaks between tours).

True Social Network for Music

Music is a profoundly social experience. Humans typically play music together in groups (bands, orchestras) and experience music together in groups (live shows). With that understanding in mind, the total lack of social dynamics embedded within our current digital music experience is troubling. Spotify allows users to create playlists and follow each other, YouTube allows users to comment on music videos; but the reality is there is very little social interaction on the digital platforms we consume music on. This appears to be a massive opportunity.

There are signs of experimentation. As mentioned above, Sound.xyz is integrating comments on music NFTs to create social engagement. Projects taking a protocol approach (see framework above), like Nina Protocol, have the opportunity to create a “social graph” around music that has been non-existent by enabling the creation of a web 3 music ecosystem (record labels, fan curation, blogging, etc.) built on their protocol.

It is early but web 2 showed the world the power of digital social networks. I think the world is in need of a web 3 social network for music.

Appendix: Royalty NFT examples

Royal

Ex: https://royal.io/editions/diplo-dontforgetmylove

Artist: Diplo

Song: Don’t Forget My Love

Streams: ~20m in 2 months since release.

Assumptions:

Revenue per stream: I used a weighted average between Spotify, Apple Music, and Amazon Music.

I started with ~95m streams in the first year and decreased by 20% per year. The result is ~430m streams in the first 10 years.

Discount rate: 12%

Duration: 50 years; ~10m streams per year after year 11.

Decent

Ex: https://beta.decent.xyz/marty-grimes/bad-decisions

Artist: Marty Grimes

Song: Bad Decisions

Assumptions:

Revenue per stream: I used a weighted average between Spotify, Apple Music, and Amazon Music.

I started with ~5m streams in the first year and decreased by 20% per year.

Discount rate: 15%

Duration: 3 years