L2 Usage and Development

**Update: I have begun working with DAO Pulse to contribute research. DAO Pulse is a nascent project building a product focused on social/usage engagement for protocols. Below is the first article that I contributed to DAO Pulse, the focus being on the current state Ethereum L2s.

January has been a bit rough given I had a protracted battle with COVID and market conditions have been depressing. As an update, I am hard at work on ZK World pt. 4 that focuses on StarkNet!

L2 Usage and Development

*Note: all data points in this report are as of January 12, 2021.

Discussions about how to scale the Ethereum blockchain are nothing new; Vitalik himself has been writing about the different scaling methods for years (see here for a 2019 post). In April, 2021, as the price of Ethereum and active users on the network ripped to all-time highs, the overburdensome cost of using Ethereum became a major issue for not the first time. The beauty and promise of blockchains is to provide a trustless and censorship resistant computing platform able to democratize access to applications built for the many people left out of current systems. If this is the ideal, $100+ gas fees (as has frequently been the case on Ethereum) to make a simple trade between two assets is unpalatable at best and, at worst, out of the realm of possibility for most.

There have been scaling solutions that have gained traction in the past, most notably Polygon Network (a PoS sidechain), but Vitalik and the Ethereum team have stated clearly that they see rollups as the ultimate Ethereum scaling solution. I have previously written in detail about the progression of Ethereum L2 scaling here but, in the interests of providing clarity, rollups have the ability to create an L2 scaling environment in which decentralized applications (dApps) can port from L1 to L2 with little to no change in code (EVM compatibility) while maintaining the security from L1 (rollups send some per transaction data to L1 that allows users to check L2 funds on L1). In so doing, rollups batch transactions on L2 to be executed before being reconciled back to L1; this significantly reduces transaction fees.

There are two types of rollups — fraud proof and validity proof — based on how the L2 transactions are verified back to L1. Fraud proofs rely on users in the system to bring forth claims of fraud that are then arbitrated, while validity proofs rely on mathematics and cryptography for verification. For more detail on the differences between the two, see here. Rollups that use fraud proofs are called optimistic rollups due to the “innocent until proven guilty philosophy”, while validity proofs are often labeled zero-knowledge rollups (zk-rollups) as zk-rollups use zero-knowledge proof cryptography to verify L2 transaction batches.

The consensus roadmap for rollup scaling was to focus on optimistic rollups in the short-term and zk-rollups in the long-term. Optimistic rollup technology has long been further along in development, and many believed building an EVM compatible zk-rollup was years away due to technological complexity. Optimistic rollups like Optimism and Arbitrum thus launched on Ethereum mainnet in the second half of 2021 after much anticipation and testing (Optimism did a gradual rollout beginning in January 2021; more on this later). Surprisingly, zk-rollups from zkSync and StarkNet gained pace and are now right on their heels of their optimistic rollup friends, with zk-rollup EVM compatible platforms set to launch soon on mainnet.

With that brief introduction to set the stage, this report will now turn its focus to usage and development of the major rollup solutions — Optimism, Arbitrum, zkSync, and StarkNet.

Optimistic Rollups

Optimism is an optimistic rollup L2 built on Ethereum. Optimism PBC is behind the development of Optimism and has taken a gradual approach to launching on mainnet as compared to Arbitrum. In January 2021, Optimism conducted a soft launch with limited functionality, then, in August 2021, a whitelist application process began for protocols to be approved for mainnet. Optimism has stated the whitelist allowed for direct lines of communication between the Optimism team and projects building applications. This gave the projects building on Optimism more control over the direction of the protocol, while allowing the Optimism team to hear directly from dApp builders on pain points.

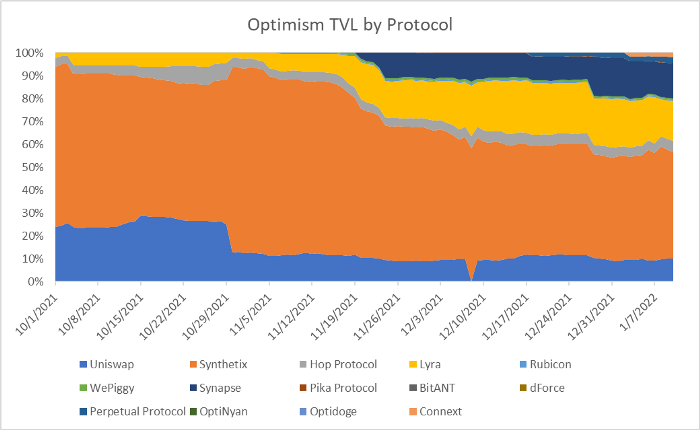

As a result of the whitelist, there was initially a limited number of protocols including Uniswap, Synthetix, and 1Inch available for use on Optimism. The tightened feedback loop between dApp builders and the Optimism team led Optimism towards its OVM 2.0 upgrade. This OVM 2.0 upgrade was completed in early November 2021 and has the benefit of creating an EVM equivalent as opposed to an EVM compatible environment, as well as reducing transaction fees (EVM equivalent vs. EVM compatible is a technical subject outside the scope of this report; see here for further reading). As of mid-December, 2021, the whitelist has been removed by the Optimism team. This opened the door for projects to launch on Optimism L2 without waiting for the need for an application to be approved. It will be interesting to observe the level of developer activity this brings in early 2022.

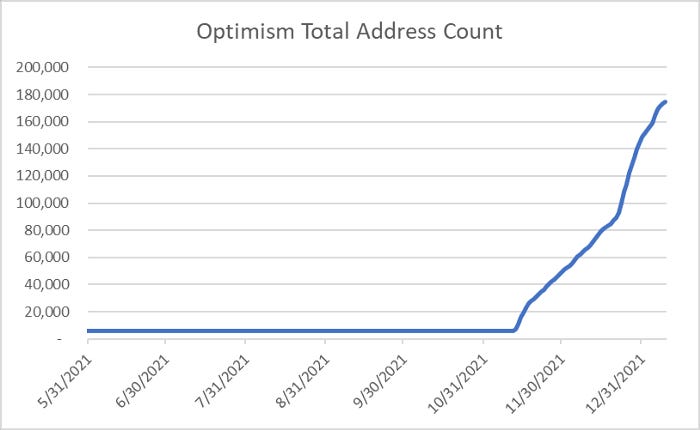

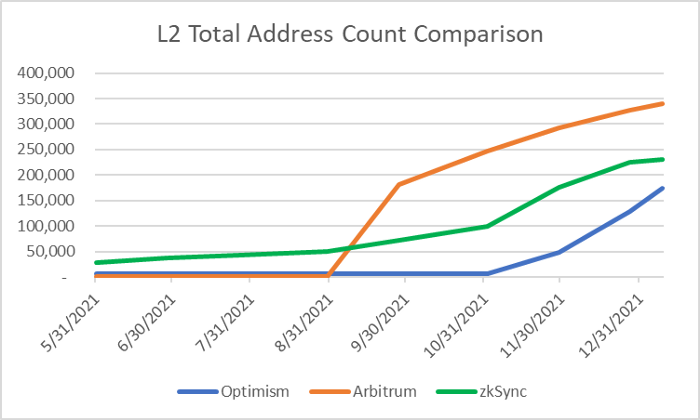

Since completing the OVM 2.0 upgrade in November, Optimism has experienced strong user growth. After a surge in interest over the holiday season, Optimism now has approximately 170,000 users. It is worth noting that address count can be a misleading metric given some users have multiple address (for example: airdrop farmers).

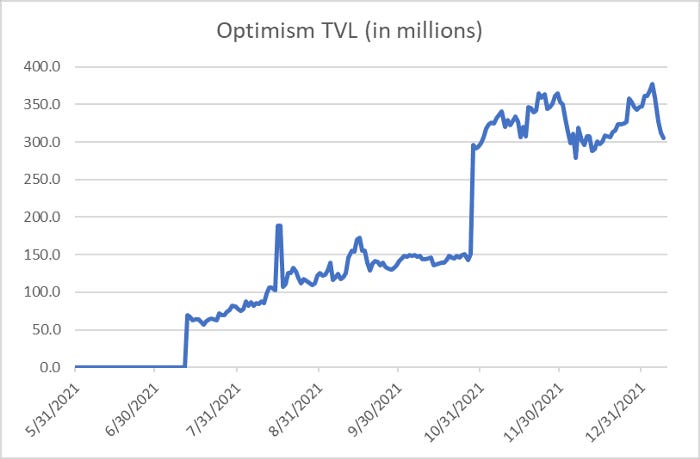

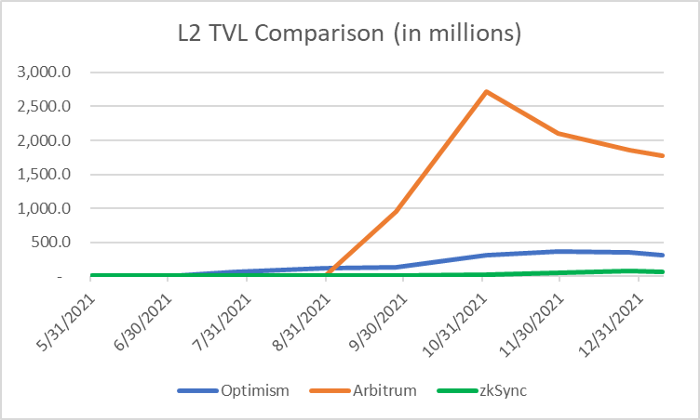

Another important metric to consider is total value locked (TVL), here Optimism trails Arbitrum significantly. It would appear that the whitelist led to a much slower dApp deployment, something that has hurt Optimism’s TVL growth (in addition to lack of incentives and high fees relative to alternative L1s). In late October, however, Optimism experienced a surge in TVL, effectively doubling overnight from $150.0 million to nearly $300.0 million. This was the result of the launch of Lyra protocol airdrop rewards farming, which went live during that time. Since then, despite the continued user growth, Optimism’s TVL has remained stagnant. Given the whitelist removal in mid-December, I would expect Optimism’s TVL to increase with further dApp deployment on the platform.

Looking deeper into Optimism’s TVL, it remains dominated by a few protocols, Uniswap, Synthetix, and Lyra specifically. According to Defi Llama, there are 14 protocols with value locked on Optimism. As we will see below, this is meaningfully below the number of dApps deployed on Arbitrum. These data points show that although Optimism has gained tens of thousands of users, the amount of capital on the platform remains limited.

It is worth noting that Optimism (as well as Arbitrum) has yet to fully decentralize — the protocol is still controlled by a multisig. This could prevent certain market participants from bridging funds to L2.

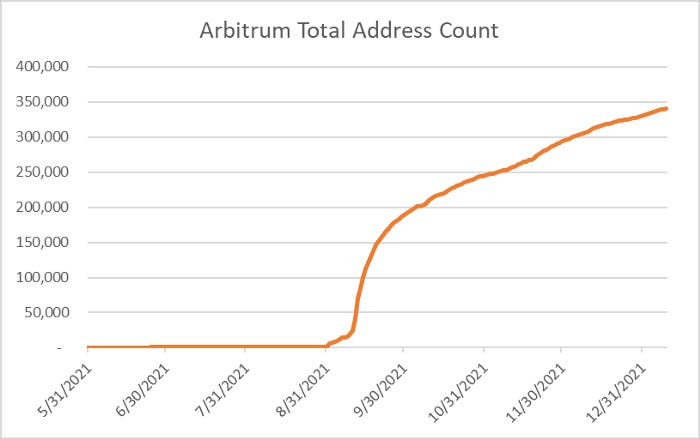

Arbitrum is an optimistic rollup L2 built by OffChain Labs. The project was on testnet beginning in October 2020 before Arbitrum One launched on Ethereum mainnet in August 2021. Unlike Optimism, Arbitrum did not have a whitelist for projects looking to launch on L2. Leading up to the Arbitrum One’s launch, 400 projects had been given mainnet access. The result was that when Arbitrum launched applications were able to port onto L2 without going through the process of a whitelist.

Once Arbitrum One launched at the very end of August, it only took two weeks for the platform to get to 100k users. Since the parabolic post-launch growth, Arbitrum One has seen steady growth in users, now at nearly 350k total addresses. Although Optimism has experienced strong growth in late 2021 and early 2022, Arbitrum has approximately 2x the users that Optimism does — 350k compared to 175k.

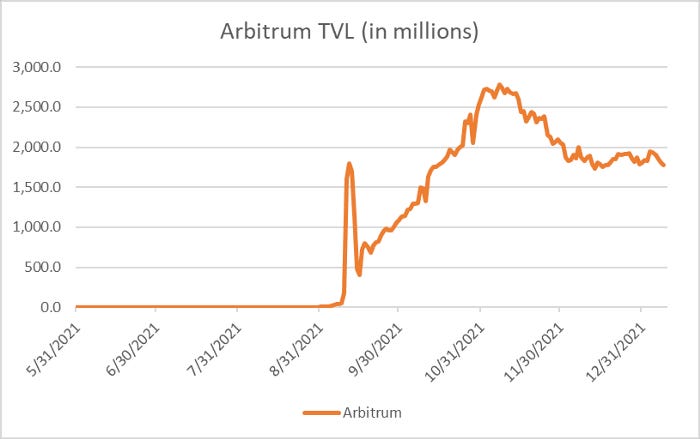

The early growth in the Arbitrum ecosystem was helped by the number of dApps on the platform. Arbitrum did not do a layered release with a whitelist for protocols that wanted to launch on the platform. The potential to use many popular Ethereum dApps on Arbitrum with cheap fees helped fuel strong TVL growth. After peaking at over $2.5 billion in TVL in early November, Arbitrum TVL now sits at $1.7 billion, down due in large part to the market selloff. Arbitrum’s current TVL nevertheless remains over 5x that of Optimism’s.

When a user wants to move funds from L1 (Ethereum) to L2, the user still often must interact with L1 in order to send funds to L2; this can be prohibitively expensive. While much infrastructure has been built out (L1 to L2 bridges, L2 to L2 bridges), being able to move funds to L2 without having to pay high L1 gas fees is still a work in progress. It is early but Arbitrum is working with Binance (the largest centralized exchange — CEX) to allow CEX to L2 transfers. This capability should allow users to efficiently transfer funds to Arbitrum in the future.

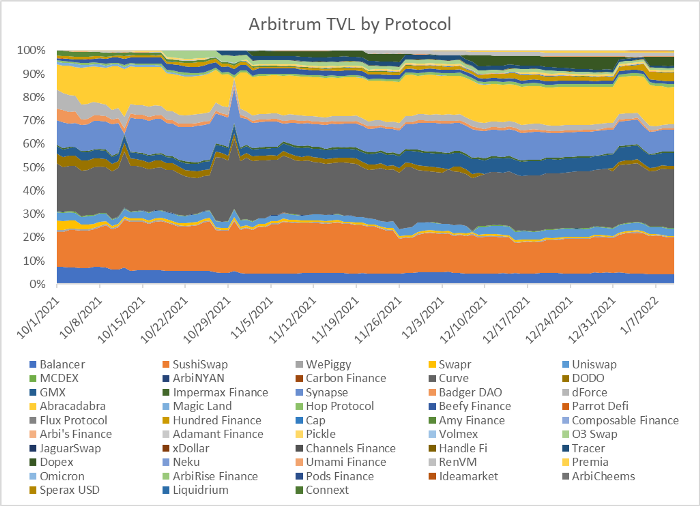

When looking at ecosystem development, per Defi Llama, Arbitrum hosts 50 dApps with at least $1.0 million in TVL (compared to 14 on Optimism). The leading protocols in TVL on Arbitrum include Curve, SushiSwap, and Abracadabra; all major players on L1 as well. In looking at the leading protocols on Arbitrum, it is worth noting the lack of “Arbitrum native” projects (Cap Finance and Dopex being exceptions). As the TVL by protocol graph indicates, the leading protocols on Arbitrum are protocols with strong L1 legacies. I think that it will be important for L2 native projects to emerge for L2s to reach their full potential.

There are two developments that could impact Arbitrum’s trajectory moving forward:

Arbitrum Nitro is a major upgrade that Arbitrum has in the works. It aims to improve Arbitrum’s EVM compatibility (thus, making development more efficient) and an “order of magnitude” improvement in speed.

On January 9, 2022, the Arbitrum One network went down after the main sequencer had a hardware issue. While many networks have experienced similar issues, serious outages do have the potential to stunt growth (a similar outage for Arbitrum occurred in September, 2021).

While Optimism and Arbitrum are clearly the leading optimistic rollup L2 platforms, Boba Network and Metis Andromeda (both Optimism forks) have gained approximately $150.0 million in TVL each. Boba Network launched a token in an airdrop to OMG holders and has a few native protocols live (most notably Oolong Swap). Metis is also at an incredibly early stage, having experienced a recent surge in TVL following the launch of Netswap (with attractive APY’s).

Zk-rollups

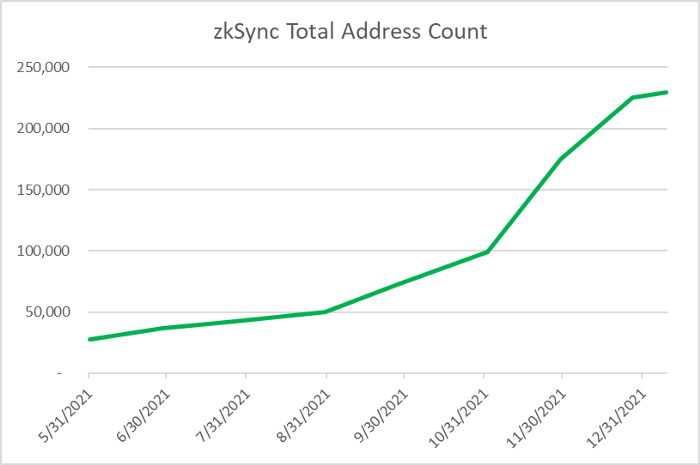

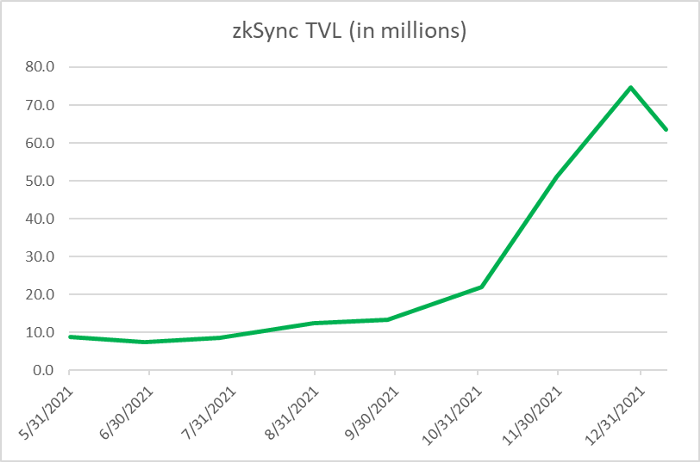

zkSync is a zk-rollup L2 scaling solution on Ethereum built by Matter Labs. zkSync 1.0 is an application specific zk-rollup that originally launched on mainnet in July 2020. zkSync 1.0 currently allows users to transfer funds to other L2 accounts, as well as interact with a small number of dApps (zkNFT and ZigZag Exchange). While zkSync 1.0 has been instrumental in showing the power of zero-knowledge proof technology, what is even more exciting is that Matter Labs is set to release zkSync 2.0 in the first half of 2022. zkSync 2.0 is an EVM compatible zk-rollup, and as stated above this technology coming to market was thought to be years away. The hype and excitement shown for this technology in the marketplace can be seen in the surge in users that zkSync 1.0 has experienced. zkSync 1.0 users now sit at 230k despite only being able to transfer funds between L2 wallets and make simple exchanges on ZigZag Exchange. This is more users than Optimism has despite not having launched an EVM compatible product (zkSync 2.0). zkSync has been proactive in establishing fiat to L2 and CEX to L2 capabilities. This has helped user growth as users can send money to L2 without paying L1 gas fees.

TVL on zkSync is rather low compared to the number of users. This has a lot to do with the limited number of dApps that can be used once funds are on zkSync 1.0. zkSync has also stated clearly there will be a zkSync token, there is certainly some proportion of “airdrop farmers” within the total address count (though to be fair there are also airdrop farmers in other L2 projects).

As has been mentioned, until the release of zkSync 2.0 (the EVM compatible zk-rollup), the development on zkSync is limited by the nature of zkSync 1.0 being an application specific technology.

zkSync is focused on porting smart contracts written for Ethereum L1 (thus largely written in Solidity) to L2 on zkSync 2.0. On a longer time horizon, zkSync sees Rust based languages winning, and thus will shift focus to Zinc development (zkSync’s native Rust based language). This approach differs from StarkNet (more to come).

StarkNet is an EVM compatible zk-rollup platform on Ethereum being built by StarkWare. StarkWare was founded by the creators of STARK proofs and has been successful in building application specific zk-rollups via its StarkEx platform (most notably for dYdX) and launched StarkNet on mainnet at the end of November 2021. The platform is still nascent, with a lot of the necessary infrastructure currently being built-out. That said, there are several protocols under development including JediSwap, Briq, and Dope Wars. There is also a community effort to port Aave v3 to StarkNet.

StarkNet has placed a lot of focus on development in Cairo (its native language for StarkNet) but is also working on developing a transpiler to convert EVM code to Cairo to run on StarkNet. This approach of focusing more on Cairo native development from the beginning runs in contrast to zkSync’s approach of focusing on porting L1 dApps to L2 in the short-term.

StarkNet and zkSync 2.0 have technological differences (most notably use SNARK compared to STARK proofs; see here for detail on the differences) that we will not dive into here but both show immense potential.

Polygon, through in-house development and acquisition, now hosts a handful of zk projects that should launch in the near term. This includes Hermez and Mir (Polygon Zero); Polygon Zero just released an upgrade called Plony2 that claims to be the fastest zk-rollup solution to date. Although the zk solutions being built by Polygon are behind zkSync and StarkNet, they are an important player to monitor in the future.

Conclusions

After months of anticipation, L2s on Ethereum have launched on mainnet. Optimistic rollups — Optimism and Arbitrum — were first out of the gate, and while their development continues, some have been disappointed and shown disinterest. This largely seems due to the lack of incentives for users to bridge funds (wen token?) and the high fees (relative to alternative L1s) to use these optimistic rollup L2s. Currently, even Arbitrum (the most used L2) trails alternative L1s like Solana and Harmony in user count.

“zk-rollup” became a buzz word on crypto twitter in late 2021, as any token with “zk” in it immediately 3x’ed. On the back of this hype and a rumored airdrop, zkSync has eclipsed Optimism in total users despite not having launched their EVM compatible platform (zkSync 2.0). Given the advantages and excitement of zk technology, this could be the early signs of zk-rollups winning market share over optimistic rollups despite more nascent development.

L2 native projects that are new and exciting have been limited on Optimism and Arbitrum as most dApps available on those L2s are legacy L1 Ethereum dApps. This should change with Optimism removing its whitelist, Arbitrum Nitro upgrade, zkSync 2.0 set to launch, and StarkNet development growth following mainnet launch. Monitoring the development of these ecosystems will prove important as I think L2 native projects (mixed with better incentives) have the opportunity to galvanize more usage for L2s.

Appendix

Below are comparative charts for users and TVL: