Cosmos Ecosystem Development and the EVMos Opportunity

Here is link the Medium article: https://daopulse.xyz/cosmos-ecosystem-development-and-the-evmos-opportunity-a740ef5105a3

Originally conceived as a white paper, the Cosmos “internet of blockchains” is a grand vision for a decentralized and interoperable future. After years of work, this vision has begun to manifest itself as blockchains built using the Cosmos SDK have gained adoption; namely Terra and Osmosis. This has resulted in Cosmos’ native token, ATOM, surging into the top 20 most valuable projects in crypto by market cap. Arguably the most exciting new project within this burgeoning ecosystem is EVMos (EVM/Cosmos), the first inter-blockchain communication (IBC) protocol compatible Ethereum Virtual Machine (EVM) based blockchain. With an anticipated launch in late February, EVMos seeks to be the “port of entry” for EVM assets and dApps; bringing the EVM world into the Cosmos universe.

This piece will begin with a brief introduction to the often misunderstood world of Cosmos, before focusing in on EVMos and the potential of IBC + EVM.

Cosmos:

The Cosmos Network is built on three fundamentals: Tendermint Core consensus mechanism, Cosmos Software Developer Kit (SDK), and the IBC.

Tendermint Core: Byzantine Fault Tolerant (BFT) proof-of-stake (PoS) consensus algorithm that sequentially elects one validator in the network to execute a block. More detail here.

Cosmos SDK: software developer kit comprised of many modules that give developers a framework to build application-specific blockchains (all code is open-source). Containing fundamental modules (governance, staking, IBC), and many others built by community developers over time, that are then used at developers discretion to build their application-specific blockchains as needed. More detail here.

IBC: protocol enabling application-specific blockchains to communicate, and thus, transact between each blockchain within the network. This creates interoperability amongst blockchains. More detail here.

The Cosmos Hub is an application-specific blockchain built utilizing these fundamentals, which serves as a hub for the Cosmos internet of blockchains (also called the “interchain”); it is secured by the staking of ATOM tokens (PoS consensus via Tendermint One). A hub is a blockchain that is integrated with IBC, that has many channels connected to it (a channel allows communication between two IBC connected blockchains in the network).

Application-specific blockchains (like Terra) that have been built using the Cosmos SDK, then plug-in to the Cosmos Hub (through which the blockchain can communicate utilizing IBC). The major advantage of application-specific blockchains is they can be designed and built for their own respective use cases (as compared to EVM chains that are general purpose to ensure all dApps can develop and deploy to the same blockchain). The result is a “hub-and-spoke” architecture; the spokes in Cosmos are zones (or hubs if they integrate many IBC channels; thus, the Cosmos Hub is not technically the only hub within the ecosystem). Unique to Cosmos, each blockchain plugged-in to the Cosmos Hub has its own set of validators that ensure security of the blockchain; thus, each blockchain is “sovereign”.

The issue then becomes, how is interoperability enabled within an ecosystem of sovereign blockchains? Enter IBC as the missing piece to the puzzle!

Think of each blockchain within the Cosmos ecosystem as a sovereign nation, and each nation would like to engage in trade with other sovereign nations. As in the physical world, shipping containers are used to conduct trade. Paramount for this trade network is a set of standards (a protocol) for shipping containers so that the ports and ships used are outfitted in a uniform manner (imagine trying to play Tetris to load a freight ship with containers of all different sizes… talk about supply chain issues… too soon, I know).

Without a uniform protocol, trade between nations (blockchains) would be near impossible. Within the Cosmos ecosystem, IBC acts as this protocol for shipping container standards. This effectively allows application-specific blockchains in the Cosmos ecosystem to transact amongst one another; the cargo is transported via relayers (who adhere to the IBC protocol for standards on how to transport the cargo).

The IBC protocol went live in February 2021, though Terra (the largest TVL blockchain in the Cosmos ecosystem) did not enable IBC until Fall 2021 via their Columbus-5 upgrade. Osmosis, another prominent blockchain built utilizing the Cosmos SDK, was IBC native from day one. It went live in June 2021 and has expanded IBC adoption.

With that basic introduction in mind, let’s take a look at how the Cosmos ecosystem has developed.

Cosmos Ecosystem:

At the core of the ecosystem is the Cosmos Hub, which is secured by stakers of the ATOM token. Historically, the Cosmos Hub has predominantly been used for security (via ATOM staking; IBC also enables shared security… more on this in the EVMos section). There are debates within the community as to whether the Cosmos Hub should remain neutral by not adding functionality. While neutrality is important, others worry about the lack of value accrual to the ATOM token (and thus, network stability/security over time). These debates have led to a few important developments for the Cosmos ecosystem; the Gravity Bridge and Prop 56 most prominently.

The Gravity Bridge is a DEX which allows transfers between Cosmos and Ethereum. It is built by Althena but plans to port to the Cosmos Hub. While this should help drive value to the ATOM token, it puts the Cosmos Hub in competition with blockchains built using the Cosmos SDK (and that are plugged into the Cosmos Hub). Nonetheless, the Gravity Bridge went live in mid-December 2021, and is in the process of porting to the Cosmos Hub.

Proposition 56 added an IBC router to the Cosmos Hub (remember, routers actually move the information in IBC). The idea is that as the ecosystem expands, it is not going to make economic sense for each application-specific blockchain to connect to every other blockchain within the ecosystem (routers are not free). Thus, by connecting to the Hub via IBC, the Hub can connect blockchains that otherwise would not be able to communicate. The proposition establishes a tax on these transactions, which will be set at zero initially to focus on growth, but can increase in the future.

Now let’s take a look at other prominent blockchains plugged into the Hub to better understand the potential of the Cosmos ecosystem.

Terra

Terra is a sovereign PoS blockchain built using the Cosmos SDK by Terraform Labs. Terra’s ambition is to create a decentralized financial ecosystem with the Terra algorithmic stable coin (UST for US dollars; EUT for Euro) as the currency for this ecosystem. The protocol has complexities (for that read the whitepaper here), but here is a high-level overview:

the Terra blockchain functions with two assets, the Terra stable coin and the Luna token. The Terra stable coin peg is maintained by shifting market volatility onto the other asset, Luna.

if the UST peg drops below 1:1 in the market, UST is bought back in exchange for Luna. In doing so, the reduced UST supply causes the market rate of UST to rise (thus maintaining the peg), with the increased supply of Luna reducing the market price of Luna (all else equal). The same mechanism plays out if the UST peg rises above 1:1.

Given that more demand for the Terra stable coin leads to the reduced supply of Luna, the system is incentivized to see Terra stable coin adoption grow. To foster this growth, dApps are deployed on the Terra blockchain.

Perhaps the best indication of the Terra ecosystem growth is Terra stable coin adoption. As the chart below shows, UST adoption surged late in 2021 (from ~$2.0 billion to over $10.0 billion). What is responsible for this explosive growth?

As noted, in late September 2021, the Columbus-5 upgrade went live. This integrated IBC into the Terra blockchain, allowing UST to be utilized on other IBC enabled blockchains outside of Terra. This allowed UST to expand to other blockchains within the Cosmos ecosystem (such as, Osmosis and Juno). As a result, UST is becoming the de-facto stablecoin of the Cosmos ecosystem (it will be interesting if wrapped USDC coming from EVM ecosystems, once enabled by EVMos, into Cosmos takes significant market share).

After months of development, many dApps began to launch on the Terra blockchain post the Columbus-5 update. Anchor, a protocol offering ~20% APY on UST, has been the most popular; likely many fled to stablecoins as market conditions began to deteriorate in late November.

In 2021, stablecoins experienced astonishing growth as the total market capitalization of the crypto industry reached all-time highs. UST has been a prime beneficiary of this trend, now ranking as the 4th largest stablecoin by value. At the start of 2021, UST was rarely used; flashforward to today and UST has ~7% market share in the ~150.0 billion stablecoin segment.

As noted above, Anchor has benefited from capital seeking high stablecoin yields in declining markets. The demand for these yields pushed the TVL over $20.0 billion in mid-December. In what was the most anticipated dApp launch for the Terra ecosystem, Astroport went live in late 2021; this proved to be a boon to growth.

Osmosis

Osmosis launched in June 2021, and is a DEX (automated market maker — “AMM”) that is not a dApp built on the Cosmos Hub, but rather a sovereign (own set of PoS validators for security) application-specific blockchain serving as a hub, in and of itself, for IBC communication.

As a reader, you might think, “not another DEX; there are ten on every chain. They are all the same”. However, Osmosis is not your grandfather’s DEX.

As an AMM, Osmosis is unique in that nothing about the underlying structure of the AMMs is hard-coded. What this means is that there is a high degree of customizability, which allows for iteration based evolution over time. In practice, liquidity providers (LPs) to Osmosis can create new pools with customized parameters (Ex: the AMM curve, swap fees, and pool weights are all parameters that can be adjusted). Thus, instead of having to upgrade the protocol, or launch an entirely new version of the protocol, Osmosis positions itself to be on the cutting edge of constant AMM experimentation and innovation.

This customizable AMM model (and some juicy APR’s) has led to strong TVL growth for Osmosis. Of note, after OSMO (Osmosis’ native token), ATOM, UST, and LUNA are the tokens with the most liquidity in the protocol; the power of IBC in action! Coming in fifth on that list, JUNO (see below).

Looking at the bigger picture, Osmosis is establishing itself at the center of liquidity and IBC transfer in the Cosmos ecosystem.

Juno

Juno is an interoperable smart contract platform, built as an application-specific blockchain, that serves as a hub within the Cosmos ecosystem. It is a community driven effort, aiming to maintain the neutrality of the Cosmos Hub by offloading smart contract development to Juno. What is unique about Juno is that it utilizes CosmWasm (Cosmos WebAssembly) smart contracts. CosmWasm is a module enabling WebAssembly (WASM) virtual machines in the Cosmos SDK. WASM serves as an intermediate programming language by compiling the developer’s programming language of choice into a virtual machine. Importantly, this allows developers in the Cosmos ecosystem to develop applications in different programming languages (for example, Rust), which was previously unavailable within the Cosmos ecosystem.

Juno is secured by its own set of validators (sovereign blockchain); the JUNO token was stakedropped to ATOM stakers (47% of genesis supply).

Development on Juno is still very nascent. JunoSwap is the main dApp that is live, with current TVL of approximately $10.0 million. Despite the early stages of development, the JUNO token ranks fifth in total liquidity on Osmosis. The public market also sees the potential; the market capitalization of JUNO has surged to $750.0 million (on the brink of entering the top 100).

Stargaze

In many ways, 2021 was the year of the NFT. Beginning on Ethereum with projects like CryptoPunks and Bored Ape Yacht Club, NFT mints proliferated across blockchain ecosystems. OpenSea, the largest NFT marketplace, experienced parabolic growth; reaching ~$3.5B in volume in August, and ~$3.0B in September. The NFT market then cooled off, leaving some to think it was just a fad… Then in January 2022, OpenSea did record volume of ~$5.0B, and Google Trends analysis now indicates that for the first time more users are searching for “NFT” compared to “crypto”. NFT’s are a big deal, and no ecosystem is complete without them.

During all of this, the Cosmos ecosystem lacked the tooling to mint NFT’s, leaving Cosmos far behind NFT powerhouses Ethereum and Solana. Enter Stargaze, a Cosmos SDK application-specific blockchain built for NFT’s. Stargaze aims to provide the Cosmos ecosystem with the tooling to mint, as well as the marketplace to buy/sell NFT’s on Cosmos.

Compared to NFT marketplaces on other blockchains, Stargaze is unique in that (like other zones in the Cosmos ecosystem) it is its own blockchain. To ensure a fair distribution, Stargaze conducted a liquidity bootstrapping pool on Osmosis for its token, STARS (there was also an airdrop to Cosmos ecosystem participants). STARS can be used to participate in governance, stake, interact on Stargaze, and mint NFT’s. Currently, STARS token holders can stake their tokens, or provide liquidity on Osmosis.

Stargaze plans to come to market on March 2, 2022 with a genesis mint of specific projects that have applied (Stargaze notes that, out of approximately 500 applications, the top 10 to 20 will be selected). Projects planning to launch at genesis mint include StargazePunks and Stargaze Troopers. Following the genesis mint, the Stargaze NFT marketplace will go live two weeks later. NFT’s minted on Stargaze will be based on the SG-721 standard. While allowing royalties and IBC enabled NFT’s, SG-721 is similar to the ERC-721 standard used for NFT’s on Ethereum (thus, the experience will not be new for NFT lovers).

IBC Ecosystem

In analyzing the health and growth of the Cosmos ecosystem as a whole, there are three important metrics: IBC transfers, channels, and users. Going back to the global trade example, IBC transfers would be the number of trades, channels the number of trade routes between different nations (blockchains), and users the number of businesses conducting trade over said routes. Just as in the physical world, trade helps the economy (ecosystem) grow.

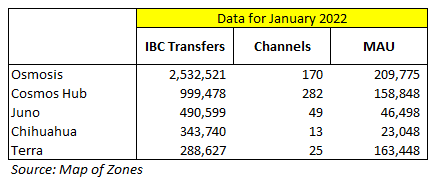

IBC transfers in the month of January 2022 were approximately 5.0 million; the lion’s share coming through the top five blockchains (see table). Data for December was unavailable, but in comparison to November 2021 IBC transfers of 1.9 million, January is up over 2x compared to November. This growth is largely attributable to three projects: Terra, Osmosis, and Juno. As noted above, these projects all had robust ends to 2021 and beginning of 2022.

Developer Activity

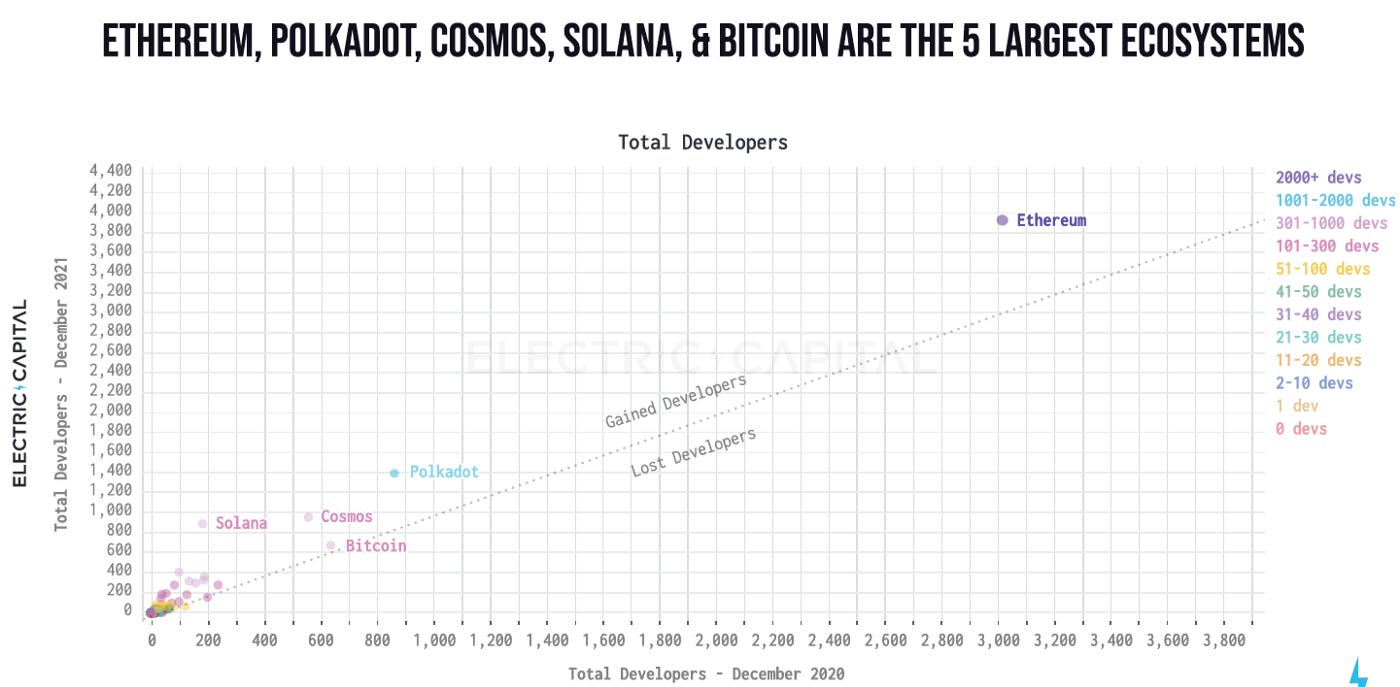

Increasingly, there is an abundance of options for developers to choose from in developing their applications. New EVM chains, Ethereum L2s, and application-specific blockchains all gained significant mind share in 2021. Per Electric Capital, Cosmos ended 2021 as the third largest development ecosystem (trailing only Ethereum and Polkadot) with approximately 1,000 full-time developers (this represents +70% YoY in that metric).

Given the fundamental importance of developer activity for an ecosystem, this growth is encouraging for Cosmos.

I went to such lengths to introduce the Cosmos ecosystem because I think it has been underappreciated by the industry at large (or perhaps, just by me). Most being familiar with the Ethereum ecosystem but not the Cosmos ecosystem. Given that EVMos brings the Ethereum and Cosmos ecosystems together, to understand the power of the potential of EVMos, an understanding of both is necessary.

EVMos:

EVMos was born out of the Ethermint project with a focus on bringing the EVM computing environment to the Cosmos ecosystem. EVMos is an interoperable smart contract platform, running an EVM development environment, and built as an application-specific blockchain utilizing the Cosmos SDK. The project’s goal is to be the port of entry for Ethereum into the Cosmos ecosystem.

Similar to other alternative EVM L1 blockchains (Fantom, Avalanche, Harmony), developers will be able to deploy both new and existing EVM dApps to EVMos. What makes EVMos unique is being interoperable with the Cosmos ecosystem via IBC. As such, EVM dApps will be able to deploy on EVMos and interoperate with all the IBC enabled application-specific blockchains built in the Cosmos ecosystem.

For example, the EVMos community is working on a proposal to launch Aave v3 onto EVMos (EVMos recently pushed its mainnet launch to February 28, 2022). Aave is a borrowing/lending protocol, and this proposal would create markets (allowing users to borrow and lend) in assets like Ethereum on EVMos based Aave. With the power of IBC, Cosmos ecosystem assets would also have markets on Aave; users could borrow and lend Osmosis, Juno, and Luna. There could also be ETH pools on Osmosis. In this way, EVMos (and the dApps built on top of it) will sit at the intersection of the Ethereum and Cosmos ecosystems (by some measures, the two largest ecosystems in crypto).

EVMos is set to be a PoS sovereign blockchain secured by EVMos validators who stake the EVMOS token. The Rektdrop airdrop of EVMOS tokens to users of both the Cosmos and Ethereum ecosystems will launch the token (EVMos was initially funded by a grant from Cosmos; the project does not have VC investors). More information about the tokenomics can be found here.

EVMos is taking a novel approach to tokenomics. The fees paid for using the blockchain will be split 50/50 between the PoS validators and developers who have deployed dApps on EVMos. This creates, by web2 analogy, a “dApp store” in which developers will be rewarded based on usage of the dApp they have deployed. dApps eligible for the dApp Store will be dictated by EVMos governance.

On a recent AMA call the EVMos team noted, 4 DEXes, a lending protocol, 2 perpetual exchanges, 3 NFT marketplaces, and 15 other dApps are in the pipeline to deploy once EVMos goes live at the end of February.

CEVMos

In mid-December 2021, EVMos announced a partnership with Celestia to build CEVMos (Celestia/EVMos/Cosmos). Going into the end of 2021, the most powerful vision in crypto was that of the modularization of blockchains. CEVMos manifest these visions by creating a modular blockchain stack, creating true specialization in data availability, settlement, and execution. Before going into detail it is important to briefly introduce Celestia.

Although Celestia has not yet launched testnet, some have already hailed it as a paradigm shift in blockchain architecture. At its core, Celestia is an L1 blockchain (built using the Cosmos SDK) that utilizes validators for security like many others. Currently, L1 blockchains (like Ethereum, Fantom, Harmony) are built to handle all three of the main blockchain functions on their own (data availability, settlement, and execution). As the industry has evolved, the need to then create modular solutions for the main functions has become apparent. What makes Celestia different is it begins with a modular framework.

Celestia is built to handle data availability and settlement but not execution. In doing so, Celestia allows developers to utilize their own execution environments of choice (for example, could be EVM or CosmWasm); meaning developers can “plug-in” to Celestia and do not have to worry about data availability or security (they can rely on Celestia’s blockchain for that).

CEVMos utilizes the modular components of both Celestia and EVMos to create a modular stack. The EVMos EVM will be specialized for settlement of transactions taking place at the execution layer, while utilizing Celestia’s data availability layer. The settlement layer (EVMos EVM) will only allow certain types of transactions, which, in effect, limits its usage to rollups (zk-rollups or optimistic rollups). In doing so, CEVMos creates a blockchain specialized for rollups at the execution layer; these rollups will not need to compete for block space with other dApp transactions (as on Ethereum). In the future, projects like StarkWare and Arbitrum could launch rollups on CEVMos.

One important question for CEVMos is, how will it be secured? Interestingly enough, by allowing communication between blockchains, IBC actually allows blockchains to share security if they so choose. Thus, CEVMos uses the EVMos PoS validators to secure its own blockchain. The EVMos PoS is backed by the EVMOS token, by securing the CEVMos blockchain, EVMos validators accrue more value to themselves (and EVMOS token holders broadly). Of course, in being IBC enabled CEVMos will be a part of the Cosmos interchain.

Conclusions:

The Cosmos ecosystem experienced strong growth in 2021. The application-specific blockchain architecture is gaining popularity within the industry. While these trends are very encouraging, from an investment standpoint, it is not clear exactly where value will accrue to within the ecosystem.

Following initial hesitancy for ecosystem blockchains to be early adopters of IBC, transactions using the IBC protocol have grown exponentially. This is early validation for the horizontal scaling model of application-specific blockchains.

Although there are now a plethora of EVM blockchains, EVMos is uniquely positioned to integrate the Ethereum and Cosmos ecosystems. It will be interesting to see how the dApp store model in EVMos’ tokenomics manifests into developer activity.

The recent Wormhole (a bridge between Ethereum and Solana) smart contract hack has raised a lot of questions as to the viability of cross-chain integration. EVMos has partnered with Nomad and Connext to bridge assets between Ethereum and Cosmos. Security of these bridges will be paramount for successful integration.

The CEVMos modular architecture breaks the blockchain into its three core functions, specializing for each. While still in development (Celestia has not yet launched testnet), the partnership is extremely promising, and could establish a new industry paradigm.